Jean-Benoit Courchesne |

The Five W’s of Microcap Investing – Part 1

This short 2-part series of articles will try to make the case for microcap investments as an alternative to large cap investments and as a diversification strategy. Following the Five Ws style, we will address 5 different aspects of investing in microcaps: Who, What, When, Why and Where. In this first part, we will go over Who should invest in microcaps?, What is microcap investing? and When one should consider it? Since this is a series geared toward the general public, we will try to make it as easy as possible to understand and put references to more complete articles at the end of the text.

Who should invest in Microcaps?

To take full advantage of the weak Market Efficiency that exists in microcaps, investors should have a value driven approach and a longer than average investment horizon. Indeed, due to the lack of financial analysis and reliable information, many “hidden gems” can be uncovered in companies valued at $250 million or less on the Canadian market. Because no research has been published and the size of these companies prohibits any institutional investor from taking a position, retail investors who are patient can outperform larger capitalization investors in the long run.

On the opposite side, quality microcap companies should be avoided by traders and speculative investors who are seeking special situations to profit in the short term. Even though it is clear that there is a lot of mispricing going on in the microcap sector, those mispricings can last for several months or years and even widen considerably due to the lack of liquidity and market efficiency. Additionally, the lack of liquidity makes these stocks very reactive to new information, possibly resulting in unexpected price swings. Finally, taking large positions in a short timeframe will often move share prices significantly resulting in a smaller potential profit.

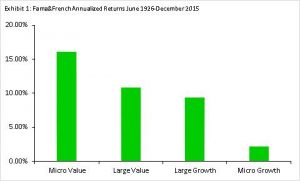

A study conducted by Fama & French on the relationship between the size of investments, the type of investment (Value vs. Growth) and the long-term return shows that value investors will make the greatest returns when investing in the lowest decile of market capitalization (microcaps) and growth or speculative investors will make much better returns if focusing on the largest capitalizations (see exhibit 1).

Since research is scarce or non-existent on most microcap companies, investors should have a better than average comprehension of the inner dynamics of a company. The capacity to understand financial information is also mandatory since an investor will need to conduct its own due diligence. Having prior knowledge of the industries one invests into can be very helpful to screen potential investments. Indeed, companies often offer industry specific information regarding their technologies. Lacking knowledge will need to be compensated by curiosity and a desire to learn in order to make sound investment decisions.

To be an accredited investor[1] is especially helpful when investing in microcaps since it allows the investor to have access to private placement opportunities. A private placement is a secondary offering, usually non-brokered, in which a company is raising additional capital from high net worth individuals and small institutional investors. It prohibits smaller investors from participating because the equity raise is done without a prospectus and thus is considered a higher risk opportunity by financial authorities. Getting into private placements is an effective way to enter into a position without having to trade on the market, thus avoiding the lack of trading liquidity. Shares are usually offered at a discount compared to market price and warrants can be added to the mix. Since the initial investment is made at a lower price than the trading price, this usually results in better returns on the investment.

What are the good opportunities ?

Historically, value microcap companies have outperformed any other size and investment style while growth microcaps have been the least performing class. Taking those facts into account, an investor should focus on finding great value companies at a reasonable valuation.

Here are some examples of What are the types of microcap opportunities that we look into:

- “Blue Chips”: We define a microcap “blue chip” as a company that has shown a steady growth in revenue for many years, with average or better than average margins for its industry, control over the cost structure (SG&A, R&D) and a positive and improving net income. We are looking for those characteristics in conjunction with a relatively low Price/Earnings ratio as well as low EV/EBITDA[2] and EV/Sales[3]. A clean balance sheet with a long-term debt to equity ratio of less than 20% is usually another investment criteria except for businesses with easily resalable assets such as land property. Another thing we want to make sure is that the company does not need to raise additional capital through an equity offering. This type of investment should be the bread and butter of every microcap investor. It follows the same principles that Benjamin Graham made famous in the past century where emphasis is put on finding great companies at a relative discount. Additionally, statistical evidences from the Fama & French study concluded that it is the optimal way to invest on a longer timeframe.

- Profitable (or nearly profitable) companies in a turnaround situation, usually after a management change. We are looking for companies with strong business fundamentals such as positive and growing operating cash flows, high double digits or above sales growth and high gross margins (typically 50% or more). We especially like it when the main reason why the company is not posting strong net income is poor cost controls by the previous management and we think it can be fixed. We usually enter these companies when the turnaround has started taking place and we see improvements in financial results for a few quarters in a row but we think the market has not yet picked up on this new potential. Such an investment bears significantly more risks than a company posting strong net income figures for a number of years. The goal here is to invest at the early stages of profitability to maximize potential returns. It is important to be careful when looking for these types of opportunities, since statistical evidence is against them. However, we are trying to determine the outliers, the companies that will, sooner than later, become «blue chips».

- Special “value plays”, usually in the form of private placements at a deep discount to market price. For a number of reasons, companies may need to raise equity at very unfavorable terms: lack of interest from the investment community, lack of liquidity in the company’s stock, too small in size for institutional investors, etc. For individual investors doing their own research and due diligence, these can represent extremely profitable investment opportunities. While those opportunities are too scarce to be our main focus, it is definitely something we are actively looking for. Another instance where we invest in a special value play is, for example, a situation where the company is trading under its net working capital value or even cash position. It is important to do extensive due diligence and to understand why these situations present themselves, since these companies are usually not profitable and if it doesn’t change, the seemingly under-valuation might persist for a long period of time.

When is the good time to invest ?

Timing isn’t everything, but it certainly helps to make higher than average investment returns. Ideally, investors should buy when they have completed a thorough due diligence and when they think that the current price represents a good tradeoff between risk and potential return. Being patient is the key to not overpay. Investors need to think in terms of intrinsic value and determine the price they are willing to pay, regardless of where the stock is trading at. Chances are that the market will present a compelling buying opportunity at some point for the patient investor. With regards to selling a security, there are a few instances when we will consider selling: i) If the price of the security is extremely overvalued based on our assumptions about the company, ii) if a fundamental change has happened and our initial investment thesis is no longer valid and iii) if we find another investment opportunity that we feel is multiple times better than the current one.

Buy low, Sell high

Especially when it comes to less liquid securities that are highly influenced by press releases, it is important to wait for a cheap entry point. It is very easy to overpay when prices suddenly rise and investors feel the need to enter into a position at that very moment. This frantic buying will often slowdown in the days following and the share price will usually come back to a more reasonable point. When this takes place, a decrease in trading volume is usually observed as well.

Beware of Pump & Dumps

Due to the lack of coverage and low liquidity, it is sometimes pretty easy for an ill-intentioned person or group to use an obscure microcap company to do what is called a Pump & Dump. A Pump & Dump is a strategy where a person or group will buy a security that is cheap based on poor business fundamentals and do promotion about the company. If the ”Pump” is successful, the stock price will rise because unsophisticated investors are buying it. The initial person or group will then liquidate its position at a profit, leaving late investors with shares in a poor-quality company that they paid too much for. While it is important to follow news regarding securities, it is equally important to use some common sense when evaluating them. Additionally, the source and credibility of the news is key to estimate if the so-called game changer news is believable or not. We generally prefer to focus our efforts on the companies we already follow rather than trying to catch the train on the securities that are ”hot” at a particular point in time.

Liquidity Risk

Microcaps’ lack of liquidity can be painful when trying to enter or exit a position. For that reason, private placement opportunities are usually the best entry points since the supply of shares available is enough to enter into a significant position. Moreover, this investment can usually be made at a discount to market price and the discount gets larger when you factor in the warrants potentially associated with the financing. For exit points, it is usually best to sell when a positive news just came out and pushed the stuck substantially higher. Since there is usually is a strong bid and a thin ask in these situations, an investor can benefit from the momentarily inflated price of the security and the much higher liquidity to liquidate his position if it does not meet his investment criteria anymore.

Avoid “Hot” stocks

Investors should be aware that microcap companies that are looking to raise additional capital are usually conducting investor relation campaigns in the preceding months. They will typically release positive information in the form of new patents, increase in orders or new distribution partners, to name a few. This often attracts traders who are making the company’s stock move to the upside on news that are not actually game changers. This will further help the company to raise capital at better terms for current shareholders. Because of that, we are careful with companies that made a strong move to the upside and that have a weak balance sheet.

To sum it up, investors should be patient when opening a position, waiting until they have completed their due diligence and that the price fluctuations are quite minimal on a day to day basis. They should be prudent with potential game changing news about a company in order to avoid Pump & Dumps. Finally, they should consider selling a security when liquidity is high if the investor’s investment criteria are not met anymore.

We hope that this first part of the 5 W’s series has been helpful in understanding the mechanics of microcap investing. We will be back next week with the second part, covering Why and Where to invest to generate above average returns in the markets.

The Five W’s of Microcap Investing – Part 2

[1] http://www.lautorite.qc.ca/files/pdf/reglementation/valeurs-mobilieres/45-106/2016-06-30/2016juin30-45-106-vofficielle-en.pdf

[2] EV/EBITDA: The ratio of Enterprise Value / Earnings Before Interests, Taxes, Depreciation and Amortization

[3] EV/Sales: The ratio of Enterprise Value / Sales