Jean-Benoit Courchesne |

The Five W’s of Microcap Investing – Part 2

This short 2-parts series of articles will try to make the case for microcap investments as an alternative to large cap investments and as a diversification strategy. Following the Five Ws style, we address 5 different aspects of investing in microcaps: Who, What, When, Why and Where. In the first part, we went over Who should invest in microcaps?, What is microcap investing? and When one should consider it? Now in this second part, we will conclude with Why someone should consider investing in microcaps? and Where is the best place to do so? Since this is a series geared toward the general public, we will try to make it as easy as possible to understand and put references to more complete articles. A bit more emphasis will be put on the statistical evidences supporting microcaps. So let’s continue:

The Five W’s of Microcap Investing – Part 1

Why should an investor consider investing in Microcaps?

Due to the lack of financial analysis on microcap stocks, a “smart” investor who does his own due diligence can reap the fruits of his labor. Indeed, the absence of institutional coverage means that important information is often misperceived by retail investors, resulting in pricing discrepancies between the intrinsic value of a firm and its price on the public market. Thus, doing superior research on a company and speaking to the management team can become a sizeable advantage over other market participants.

Value investors are the ones who can take the most advantage of the premium associated with microcaps. Statistically speaking, research shows that microcap stocks provide annual returns that are greater than those predicted by the Capital Asset Pricing Model (CAPM)[1] by about 4% per year since 1926. This means that a microcap portfolio should generate significant Alpha because returns will be greater than a typical portfolio for the same level of risk taken. The Alpha is a benchmark of the return earned relative to the risk taken, and improving it is the goal of every portfolio manager. This is a risk-weighted performance measure that helps to determine whether or not an investment strategy is sound and efficient.

A fundamental approach will yield better results if it is focused on value driven companies rather than growth ones. This requires discipline and will only prove fruitful for the long-term focused, patient investors. The CFA Institute conducted a research[2] from 1972 to 2011, dividing a universe of 2,969 stocks each year into quartile portfolios, to evaluate the return of Value stocks (low Price/Book ratio[3]) and Growth stocks (High Price/Book ratio). The first quartile portfolio, the one containing the Value stocks, achieved a compounded return of 16.13% per year for the length of the study while the fourth quartile portfolio, the one with Growth stocks, only achieved a 7.62% compounded return, less than half the return of the Value stocks. Additionally, the standard deviation[4] of returns, a measure of the volatility, was 23.31% for the first quartile and 29.42% for the fourth quartile. The combined 2,969 stocks had a return of 12.15% per year and a standard deviation of 22.39% for the period. Consequently, the study shows that investing in Growth stocks will expose the investor to greater volatility and lesser returns than what would be expected from investing in the overall market.

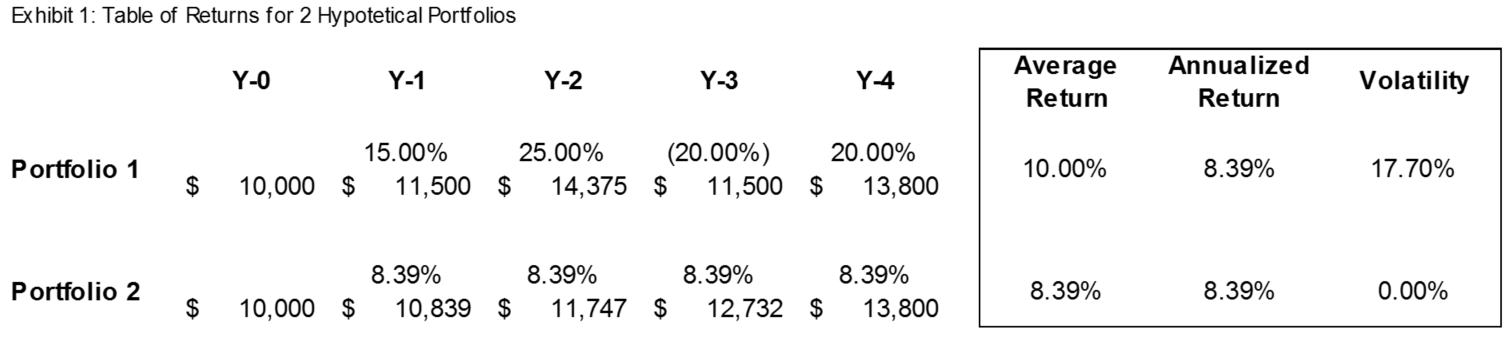

Even with the first quartile, however, it is important to understand that the returns will be generated with more volatility than with a larger capitalization investment strategy. The standard deviation of returns for small caps has been 32.3% from 1926 to 2013, which is more than 50% greater than the 20.2% for large caps. The gap is even greater with microcaps, having a standard deviation of 36.4%. This increased volatility affects the annual compound return of a given portfolio, lowering it in comparison with the average annual return. As you can see in Exhibit 1, higher average returns can be totally offset by the introduction of volatility. Factoring that, the excess annualized returns of microcaps in comparison to large caps is even more impressive.

Another reason why the microcap investor has an advantage is because of the access to niche industries. Typically, microcap companies are product-specific and only sell one or a few products or services to their target market. Since their market is relatively small at first, microcap companies are able to maintain high gross margins due to the lack of competition from bigger players. The higher margins and competitive advantages will generally last until the niche market grows enough in size to attract competitors. Taking this into consideration, our investment philosophy involves finding small companies that are growing, and that operate in a niche market that is also growing in size. We think that this combination will provide higher long-term returns in comparison to mature companies in mature industries. For further reading on this topic, we recommend an excellent article from Ian Cassel at the MicroCap Club: First… Dominate a Small Market.

Where is the best place to invest?

An investor should start by focusing on his strengths, meaning the industries he knows best. Since the investor will need to do his own due diligence on the companies he is willing to invest in, having prior industry knowledge is a key advantage. As mentioned before, completing a thorough due diligence is mandatory in order to limit risks and maximize profits. In Microcap land, a lot of companies clearly are bad investment opportunities that will perform poorly in the long-term. However, what we are looking for is the small fraction of companies that actually have revenues, earnings, that are growing and that have the long term potential to disrupt larger industries.

If you are not particularly knowledgeable about an industry but you are attracted to a company based on the quality of its financials, it can be smart to talk about it with other investors or industry professionals. Building a network of experts in various fields as well as successful long-term investors is at the core of our philosophy. Management teams are usually very optimistic about the prospects of their own company and so, for this reason, we always seek unbiased opinions from third parties. Conducting your own research is also helpful to get a general idea of the key drivers specific to that industry. Since microcap stocks tend to react strongly on new information, being well-informed enables an investor to make quick decisions when it is needed.

Sector wise, we try to invest in non-cyclical[5] and non-commodity related industries (Agriculture, Basic Goods, Household Products, …) where commodity prices and macroeconomic trends have little to no effect on the sales of a business. We will also venture into consumer goods, technology and life science companies with higher caution considering the increased risk they might represent. The probabilities of finding a stock that will become a 10-bagger or more in a short period of time is much greater in the life sciences field than in an industry such as agriculture, for example. However, the risk associated with them is also much higher. We try to find a good balance between risks and potential rewards when looking at more speculative plays.

We do not invest in mining or oil&gas (O&G) companies and do not recommend doing so unless you have extensive industry knowledge. Nearly all microcap mining and O&G ventures in Canada are in early or middle exploratory stage and a huge proportion will never get to actual production. As of 2012 (most up-to-date numbers), there were 1,254 mining companies listed on the TSX and TSX-V, of which only 76 were in the production phase. This means that less than 6% of the companies were actually generating revenues from their operations and 94% were not.

Another important factor to consider when looking at mining and O&G companies is the fluctuation in the price of the commodity extracted. For example, metals have taken a swift downfall from 2011 to the end of 2015 but have been rebounding since the beginning of this year, a trend lead by precious metals and followed by basic ones. Even though the situation might look attractive right now, it is very possible that the trend will reverse again in the second half of the year. There are a number of factors that drive the prices of commodities including global economic growth, political turmoil, natural catastrophes, industrial demand and speculation, to only name a few. Modeling those variables for the years to come can be a very complicated task and small fluctuations in value will have major impacts on the Net Present Value of a given project.

From a geographical standpoint, we currently only invest on the different Canadian exchanges for two main reasons: first of all, because those exchanges (mainly the TSX and TSX-V) are completely transparent platforms that provide reliable quotations and real-time information. There is also very little trading conducted on parallel exchanges due to the dominance of their owner, the TMX Group. If you look at the U.S. in comparison, most microcaps are traded on the OTC (Over The Counter) and Pink Sheets markets, which offer far less reliable quotations and listing requirements. The second reason for investing in Canada is because we think that the market is inefficient and that plenty of compelling investment opportunities can be found. With more than 550 companies listed on the TSX-V that are not mining or O&G related, that gives us a good universe of companies to look at. Additionally, there are far less sophisticated investors looking at the Canadian market compared to the U.S. market, so we believe that gives us an even better edge on the competition.

In summary, we are looking for Value stocks in the microcap space because these companies have historically been the ones providing the best overall returns. We are trying to find these opportunities on our own ground, in Canada, and especially in industries where we have the most knowledge and are the most comfortable with.

This concludes our 2-parts series on the 5 W’s of microcap investing. We hope that this series has been helpful in understanding the mechanics of it. Microcaps represent, in our opinion, a good way to achieve superior returns on the long-term for a value investor. Statistical evidences overwhelmingly support this opinion. We think that an intelligent investor can profit from the lack of coverage and liquidity associated with microcaps if he is able to stay disciplined and not panic in times of greater volatility.

[1] http://www.investopedia.com/terms/c/capm.asp

[2] http://www.cfapubs.org/doi/pdf/10.2469/faj.v69.n3.4

[3] http://www.investopedia.com/terms/p/price-to-bookratio.asp

[4] http://www.investopedia.com/terms/s/standarddeviation.asp