Mathieu Martin |

RSY: A growing SaaS company trading at 1x sales!

Ticker: RSY.V

Share Price: $0.145

Shares Outstanding / Fully Diluted: 36.34M / 43.29M

Market Capitalization: $5.27M

Insider Ownership: 55%

Business Overview

RSI International Systems Inc. (TSX Venture: RSY ; “RSI”) is the developer of RoomKeyPMS, a web-based Property Management System (PMS) that incorporates a fully integrated Online Reservation Booking engine and seamless real-time connectivity to the major Global Distribution and Internet Distribution Systems. RSI markets its RoomKeyPMS and other proprietary hosted software solutions to a wide variety of hospitality industry clients around the world.

RSI focuses on serving the smaller hotel chains and properties, primarily in North America, where it has carved its niche and has been growing steadily over the years. In the first 9 months of 2016, 70% of the company’s revenue originated from the United States, 19% from Canada and 11% from the rest of the world.

RoomKeyPMS is being sold on a Software as a Service (“SaaS”) model, providing the company with a steady stream of revenues and the ability to re-invest them to generate more sales. For this reason, RSI has been slightly unprofitable for most of its history and has relied on the capital markets to finance its growth. On December 23rd, 2016, the company closed a private placement offering, raising total gross proceeds of $538,610 by issuing 4,143,152 units at $0.13 – each unit comprised of one common share and one common share purchase warrant exercisable at $0.20 for up to 24 months.

The company is based out of Vancouver, British Columbia. It has been in operation since 1978 and public by way of reverse take-over (“RTO”) since 2000.

Market Opportunity and Strategic Plan

RSI’s total addressable market is composed of the small and independent North-American hotel properties. There are approximately 60,000 hotels in North America. About half of this number are branded or chain properties where RSI is not really competing. The remaining 30,000 are what the company refers to as independents (including small operators who have a handful of properties). Of the 30,000 independent properties, about half are too small and will not use technology so they are eliminated from RSI’s market potential. This leaves a serviceable obtainable market of about 15,000 properties that RSI can do business with. RSI currently serves around 800 properties with an average of 109 rooms and gets an average revenue per property of $6,000 per year, which leaves plenty of room for growth.

The opportunities to increase revenue are to increase the size of the properties that RSI can service and to charge more per room. For example, instead of charging $5/month per room on 100 rooms for a total of $500 per month, charge $7/month per room on 150 rooms for a total of $1,050 per month. There are many ways that this can happen and the company is currently evaluating its options, whether it be by expanding geographically, by servicing new types of properties or by offering new products/modules.

Our discussions with management have gravitated mostly around two areas which seem promising: entering the casino market and developing a new module for events & caterings. However, we believe that other projects could be undertaken by the company which could yield similar or better results going forward.

1) Entering the Casino market: In the casino industry, there is a need in the marketplace for solutions that integrate the Property Management System (“PMS”) with the Player Tracking System to enable better tracking and rewarding of guests. There are 2 providers who have had a stronghold on this market for many years: Opera from Oracle (NYSE: ORCL) and InfoGenesis from Agilysys (NASDAQ: AGYS). This duopoly has resulted in minimal technology improvements as well as poor customer service. RSI management sees an opportunity to interface its current product offering with player tracking and point-of-sale (”POS”) systems to be able to enter this new vertical. The initial target market would be independent (1-5 properties) and first nations casinos, and there are reasons to believe that RSI could charge higher fees per room in this industry. Also important to note is that Skywire Media Inc. (”Skywire”), a privately-held POS systems provider for the gaming industry, is a significant shareholder in RSI and might be able to help open some doors.

2) Development of an Events & Caterings module: Hotel properties typically generate anywhere from 10% to 50% of their revenue from groups and events. One could argue that having a software to manage this aspect of the business is a must-have for hotels who derive a high proportion of their revenue from this segment. This is currently a module that RSI doesn’t offer, and they have lost business in the past because of it. Developing this module would allow RSI to capture new business and most importantly, to target larger properties. The module would be developed as a stand-alone product (PMS agnostic), enabling sales into completely new markets. Management told us that they have had conversations with their own customer base and that there could be significant pent-up demand already for this module.

Thanks to the $538,610 raised in the recent private placement, the company is now better capitalized to execute on its strategic plan and, in our opinion, should be able to reach its goal of i) charging a higher price per room and ii) increasing the size of the properties that they are able to service.

In the medium to long term, growth opportunities lie in the improvement and rebuilding of RoomKeyPMS software offering. The current software has been out there for quite some time and management feels the need to gradually roll-out a newer version. In Q4 2015, RSI commenced work on a new cloud version. It will be developed module by module, using a lean framework to mitigate migration and product development risks. The first module that has been launched and is now in full use is the Housekeeping module. The company is currently working on releasing the Guest and Users modules.

Management and Board

Charles Ku – President & CEO

Mr. Ku joined RSI International in 2002 as VP of Marketing and was promoted to CEO in 2004. He has a solid background in the hospitality industry, having held previous leadership positions at Four Seasons, Hyatt Hotels and Intrawest Resorts. His base salary was $185,000 in 2016 and he owns 1,337,371 shares (~3.7% of shares outstanding) and 900,000 options.

Tim Major – CIO

Mr. Major is the company’s Chief Information Officer. He came onboard when his company, Veratta Technologies Inc. (“Veratta”), was acquired by RSI in 2011. He brings expertise in web design, web development as well as Internet marketing. Mr. Major holds a B.B.A. from Simon Fraser University.

David Keys — Director

Mr. Keys is an independent financial and operations consultant. He serves on the Board of Directors of several private and public companies. He is currently Chairman of the Board and Interim CEO of Skywire as well as advisor to the Edward W. Moody Trust. These two entities collectively own 16,364,997 shares of RSI (roughly 45% of the shares outstanding).

Adam Ho – Director

Mr. Ho joined the board of directors in August 2016. He is responsible for the corporate development and handles all the shareholder communications. He is also VP of corporate development and CFO of Zincore Metals Inc.

We had the opportunity to meet Mr. Ku in person a few months ago. He seems like a very genuine and passionate individual who understands the industry dynamics very well. We believe he will be able to steer the boat in the right direction. We also met with director Adam Ho on two occasions. He is very open to discuss with current and prospective shareholders and we noticed a huge improvement in communication between the company and its shareholders since he came onboard.

Financials

Since RoomKeyPMS is sold on a SaaS model, most of RSI’s revenues are recurring in nature. We estimate the percentage to be at least 85%. Customer retention rate has been constantly improving the last couple of years, from 79% in 2014 to 90% in 2015 and 93% in the first nine months of 2016. Gross margins are very healthy and stable at 85%. In short, we are talking high quality revenue here.

That being said, like most small SaaS companies, RSI hasn’t reached sustained profitability yet as they need to incur upfront costs to acquire new customers hoping to make their money back plus more over the lifetime of the customer relationship. The SaaS model also needs scale to be successful as a company must continuously invest in its software platform to stay competitive in the marketplace and drive growth. The larger your customer base, the lower the cost of support per customer.

Even if we do use metrics like LTV/CAC ratio and CAC payback period to evaluate SaaS companies, as investors we believe revenue growth and positive cash flows are the two most important criteria to look for. They are more reliable and less likely to be manipulated by management. Our goal is to buy a growing stream of highly recurring high margin revenue at a steep discount to market’s average multiple for comparable companies, with the margin of safety provided by positive cash flows. We will elaborate more about valuation later.

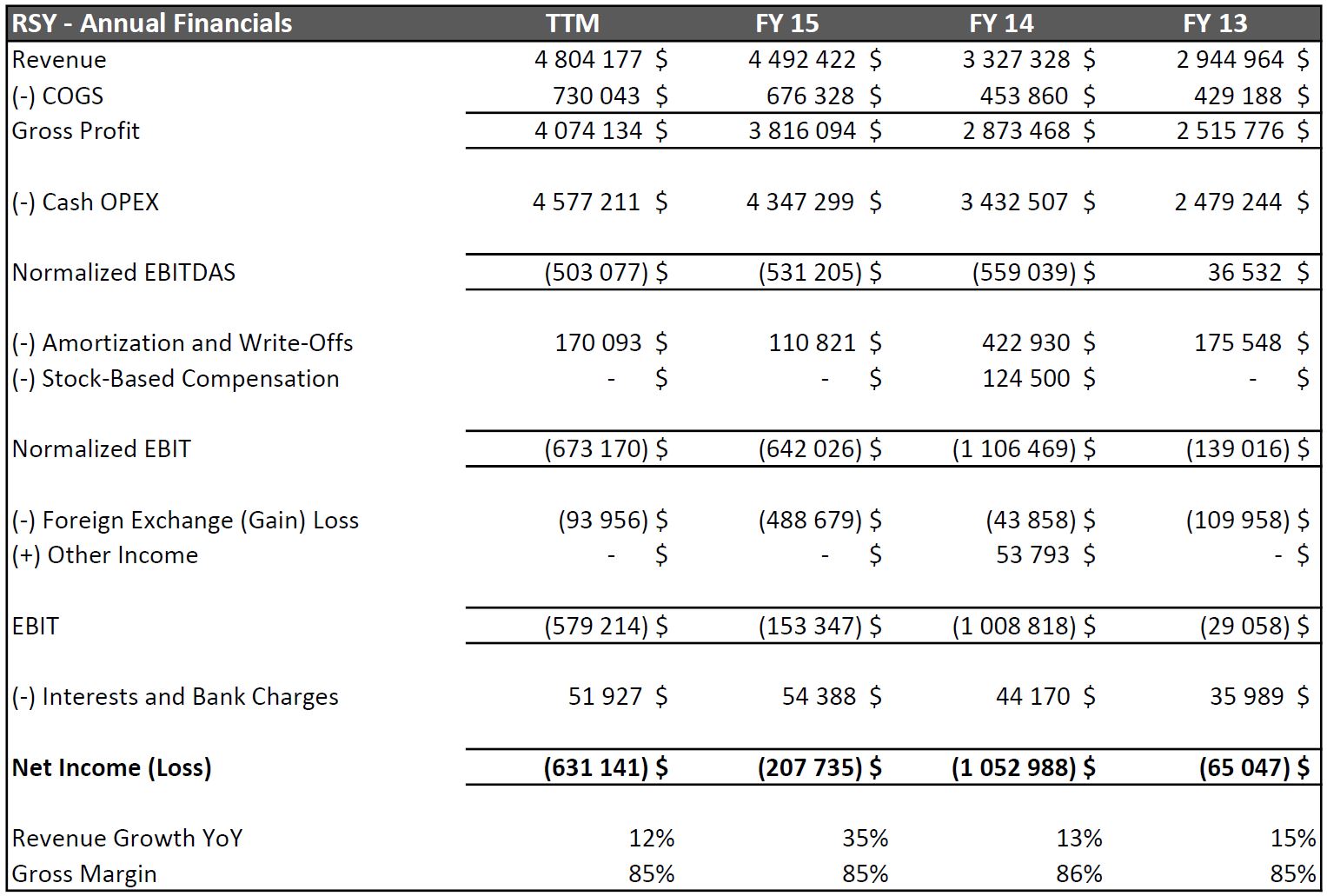

Here’s a snapshot of the company’s financial results in the last 3 fiscal years and Trailing Twelve Months (TTM):

RoomKeyPMS has shown solid growth in the past. It’s even more apparent when we strip out Veratta’s contribution, whose business was shut down during 2013:

Here are RoomKey’s TTM revenues in previous quarters:

- Q3 2016 $4.8 M +12% growth

- Q2 2016 $4.8 M +23%

- Q1 2016 $4.5 M +20%

- Q4 2015 $4.5 M +35%

- Q3 2015 $4.3 M +43%

- Q2 2015 $3.9 M +38%

- Q1 2015 $3.8 M +51%

- Q4 2014 $3.3 M +46%

- Q3 2014 $3.0 M +62%

- Q2 2014 $2.8 M +71%

- Q1 2014 $2.5 M +58%

- Q4 2013 $2.3 M +37%

- Q3 2013 $1.9 M

- Q2 2013 $1.6 M

Trailing Twelve Months (TTM) growth slowed significantly in 2016, which was a major disappointment for shareholders. We believe this is an anomaly, essentially the consequence of a major turnover in the sales department at the end of 2015. The former VP of sales left to work for a competitor and brought two other employees with her. At one point, the sales department was down to only one employee.

Management took the matter in hands and traveled a lot in Q2 2016 to meet with customers, then organized a co-design summit with their 10 largest clients. The issue has been resolved and we expect growth to start trending up again. The positive is that customer retention rate has never been higher (97% in Q3 2016) and we think the additional focus on current clients sure helped.

Finally, management burned through all their cash during 2016 because of aggressive spending in software development costs, as you can see on the deferred development costs line item in the cash flow statement. The company had to raise money at a distressed valuation in Q4 2016. We were quite happy to initiate a position, but now we would like to see them adopt a more conservative approach with regards to cost management.

Based on conversations with management, we learned that the company has undertaken a thorough review of its costs budget and we have reasons to believe they will reach cash flow breakeven in the first half of 2017, including all software development costs (current and deferred). Although there is no assurance this will happen, it would be a significant catalyst for the stock in our opinion.

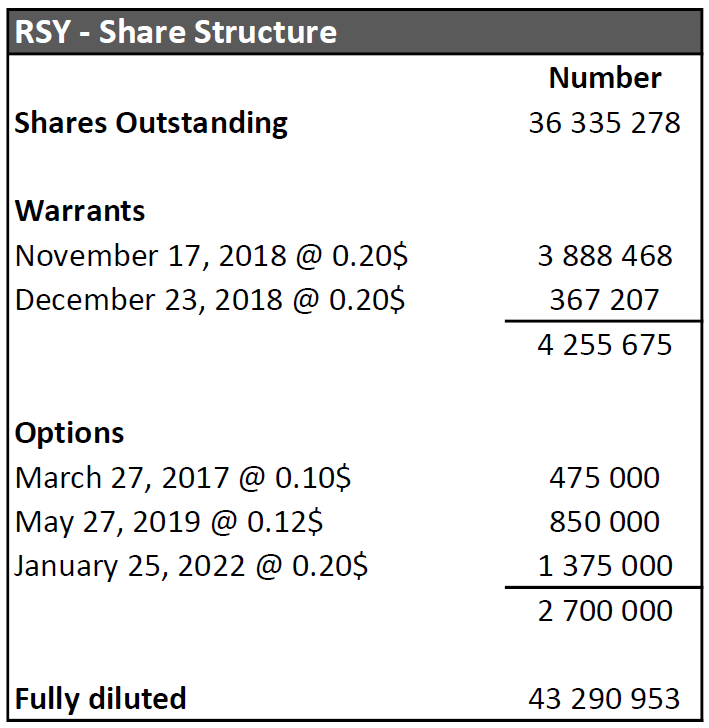

Share Structure

RSI currently has 36.34M shares, 4.26M warrants and 2.7M options outstanding. For more details, please refer to the table below:

We also like the 54% insider ownership in the stock. Skywire is highly incentivized to make their relationship with RSI successful.

Valuation

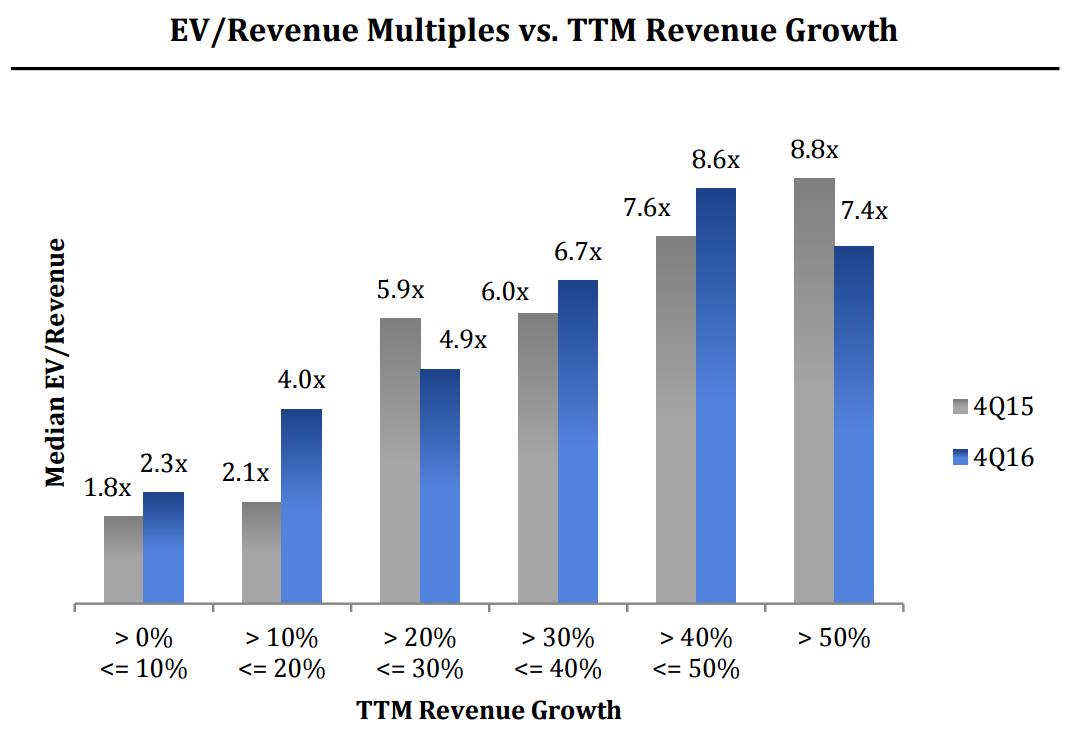

We believe the best way to value SaaS companies is to use an EV/Revenue multiple. Why? For a larger company with economies of scale, an acquisition can be very accretive to earnings even though the acquired company isn’t profitable yet. The valuation multiple can vary depending on growth rates, industry dynamics, customer concentration, percentage of recurring revenue, customer retention rate and SaaS metrics. Of course, the goal as an investor is to buy at a steep discount to the market’s average for comparable companies.

As of March 17th, 2017, RSI’s market capitalization stands at $5.27M. The company has no long term debt. Since the company has yet to achieve cash flow breakeven, we prefer to take on a conservative stance and we will not add back the cash raised in the last private placement to calculate the Enterprise Value.

Trailing Twelve Months (TTM) revenues stand at $4.8M while Q3 2016 annualized gives us a forward revenue figure of $5.24M. Based on these numbers, RSI’s shares are valued today at an EV/TTM Revenue multiple of 1.1x and an EV/Annualized Q3 2016 Revenue multiple of 1.01x.

Here is what a Software Equity Group report shows about the valuation of publicly-traded SaaS companies:

Based on RSI’s past performance and current market position, we are confident forecasting revenue growth in the range of 10% to 20% for 2017. This assumption leads us to believe that shares of RSI, if valued in line with peers, should be priced at an EV/TTM Revenue multiple of 4x.

However, since RSI is a small company and is not profitable yet, we feel that it should deserve a lower multiple than the median of peers. A more conservative 2.5x EV/TTM Revenue multiple would still result in a share price of $0.28 on a fully diluted basis, or 93% upside potential from current share price of $0.145.

This disconnect between the market value and our estimation of intrinsic value should become more apparent as the company continues to grow revenue and hopefully rectifies its cash burn issue.

For more information about how to value SaaS companies, we recommend reading this excellent 3-part article: How to Profit Investing in the Software-as-a-Service Space.

Part 2 – Part II: SaaS in the Smallcap Space and One Company to Watch

Part 3 – Part III: The Metrics You Need to Know to Profit in SaaS

Potential Catalysts

- Completion and initial sales of new modules, such as Events & Caterings.

- Entrance into new verticals, such as casinos, or new geographies.

- Achievement of cost cuttings, effectively bringing the company back to cash flow breakeven and mitigating the risk of running out of money.

- Signing of new partnerships to expand sales channels of RoomKeyPMS.

- Signing of larger and less price sensitive hotel properties and chains as customers.

Risks

- In the first half of 2016, RoomKeyPMS’ head of sales left the company to go work for a direct competitor and took most of RSI’s sales team with her. The problem seems under control and the company even increased its customer retention rate but this is still something to keep an eye on.

- The PMS space is highly competitive. Competitors with greater resources might come up with a better product and find a way to put a dent into RSI’s customer base.

- New product development risk. We like the lean framework approach that the company has adopted to develop its new cloud-based solution. However, there is no assurance that RSI’s management team will be able to adapt the RoomKeyPMS solution at a reasonable cost to fit the needs of its current and prospective customer base in the next few years.

- Even with the recent financing, the balance sheet appears weak to us given all the development work that the company has in front of itself. The company might need additional financing in the future and there is no assurance that it will be able to get it at favourable terms.

Conclusion

RSI International is an unknown, under-followed microcap company trading at a significant discount to its peers. We think that further business improvements in 2017-2018 will lead the market to realize that this discount is undeserved. The upside potential might not materialize immediately, but we see very limited risks of permanent capital losses at current levels and are happy to own shares of a steadily growing business at a cheap valuation.

If you have any questions about the company, you can reach out to director Adam Ho at aho@roomkeypms.com or by phone at (604) 329-1009.

Disclosure: Philippe Bergeron-Bélanger and Mathieu Martin are long shares of RSY.V