Mathieu Martin |

Stock to Watch: BlueRush Media Group (BTV.V)

Share price: $0.12

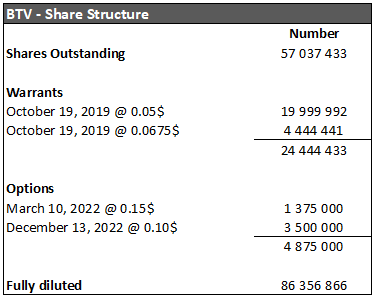

Shares outstanding / Fully diluted: 57.04M / 86.36M

Market Capitalization: $6.84M

Total debt: $1.06M

Total cash: $2.31M*

Enterprise Value: $5.59M*

Fully diluted insider ownership: 72%

* Including cash raised in the October 2017 private placement

Key Highlights

- BlueRush Media Group is a turnaround. The stock is extremely unknown and illiquid.

- The company is currently transitioning from one-time sales to a recurring revenue SaaS model. We believe that the market does not realize what is happening.

- In October 2017, a few strategic investors took a significant equity stake in the company and in December a new CEO came on board with the intent to accelerate recurring revenue growth.

- Over the years, the company developed many intangible assets that now provide a lot of optionality for the new team to monetize.

- Based on our FY18 and FY19 forecasts, we believe that shares of BlueRush Media Group are undervalued and offer a potential 167% upside over the next 2 years.

Company Overview

BlueRush Media Group (”BlueRush”) was founded in 2003 and went public on the TSX Venture Exchange in 2007 via a capital pool company (CPC) offering. BlueRush has historically been in the business of providing digital marketing services (DMS), predominantly to customers in the banking industry. DMS include work such as building websites and other online marketing programs. This was a somewhat cyclical business as banking clients went through cycles of bringing this work in-house versus outsourcing. In 2012, management made the decision to develop a few product offerings in order to build a more stable and sustainable business over the long-term by generating recurring revenues from its already impressive client roster. Over the following years, DIGITALREACH and INDIVIDEO were born.

DIGITALREACH

According to the company’s website, ”DIGITALREACH is a content management and fulfillment platform that helps advisors, consultants, and sales teams grow their book of business by simplifying client management.” This product offering is branded in 2 different ways: 1) DIGITALREACH is marketed and sold directly by BlueRush and is used by its clients to push regular content to current and prospective customers; 2) SMARTADVISOR is licensed, marketed and sold by Broadridge Financial Solutions (NYSE: BR / $10B market capitalization) in Canada, and is used for regulatory purposes following the implementation of the CRM2 regulation in Canada. CRM2 is a financial industry-wide regulation that was put in place in early 2017. It requires firms to disclose and report more information to customers. SMARTADVISOR is a tool that helps financial firms meet the requirements of this new regulation. With the 2 versions combined, DIGITALREACH is currently used at TD Bank, Manulife and many other financial institutions by over 75,000 financial advisors.

INDIVIDEO

Again according to the company’s website, ”INDIVIDEO creates personalized videos for each and every customer, provides information relevant throughout their journey, and generates loyalty.” Basically, it allows companies to send videos that are personalized to each customer in their databases. A use case, for example, could be a bank sending its customers videos about how their retirement will look like if they save a given amount of money every month for a given number of years. Or it could be a personalized insurance quote that a representative sends to a prospective customer after their first meeting. The personalized video format is much more appealing to a wide array of customers and can be used in many industries. INDIVIDEO is a very small part of revenues today. It is used by clients such as Allstate Insurance and Groupe Investors. There are many applications for this technology and the company is currently exploring how to properly exploit it.

Other Products

BlueRush also has developed intellectual property for multiple niche products such as a ”Mortgage Expert” and a ”Retirement Expert”. The Mortgage Expert, for example, is basically a financial calculator that lets a user enter basic information about his mortgage and then shows him what his monthly payment would be at a proposed interest rate. The prospective customer can then seek a mortgage or other financial products from the financial institution sponsoring the calculator. This tool can be sold as online paid content to advertisers in the financial industry, and generates revenues on a CPM (cost per thousand impressions) basis and a revenue share. Although these products don’t generate meaningful revenues currently, based on our discussions with management we believe they present significant revenue potential and provide a lot of free optionality at the current valuation.

To summarize the opportunity on a high level, BlueRush is a turnaround that is transitioning from one-time sales to a recurring revenue model. As we will see later, the company is getting some serious traction on its new product offerings and we believe that the market does not fully appreciate the magnitude of the transition happening here.

Management and Board of Directors

BlueRush was founded in 2003 by Larry Lubin. Larry has extensive experience in sales, software development and financial services. He previously built a company called Fitech that is now part of CGI. Larry and his Fitech team developed many leading applications for financial institutions.

In 2006, Len Smofsky, another successful entrepreneur with a background in visual communications and strategy, joined Larry and the team at BlueRush. Len and Larry formed a partnership to recreate BlueRush with the intent of creating personalized customer experiences using a unique blend of digital media and deep technology capabilities.

In 2012-2013, the duo realized that the way to build for future success was to develop SaaS products, which means selling software on a monthly subscription plan. After a few years of developing new products and after seeing the early commercial traction they were getting, the next step for Larry and Len was to find additional talent and expertise on the sales side.

The major breakthrough in that area happened in August 2017, when BlueRush announced the appointment of Steve Taylor to its board of directors. Steve Taylor has over 25 years of experience in the SaaS, eCommerce and digital media industries. He managed large sales teams in the past and knows how to turn a company like BlueRush into commercial success. Steve was previously the founder and CEO of Resolver Inc., a SaaS-based governance, risk and compliance company that was successfully sold to Klass Capital, a private equity firm, in 2015.

Through a private placement, Steve invested $250,000 into the company and brought along with him a high-profile Canadian technology venture capital firm, Round 13 Capital, for an additional $750,000 investment. Round 13 is led by Bruce Croxon, former dragon on CBC’s Dragons’ Den. The VC firm, which now owns approximately 25% of the company’s outstanding shares and close to 33% on a fully diluted basis, has appointed a director to the board (John Eckert) and is very active in helping the company move forward. BlueRush now has access to Round 13’s large network of successful entrepreneurs and investors, such as the co-founder of Shopify as one example.

Subsequently, in December 2017, Steve Taylor was appointed Chief Executive Officer of the company, replacing Larry Lubin who will remain involved as the President. The turnaround is now underway with a new CEO and a highly strategic investor (Round 13) on board.

Pivotal Point: October 2017 Private Placement

Although the company has a long history of not diluting shareholders, it did so in a significant way in October 2017. As explained in the last section, the company was looking for strategic partners to lead the company into its next growth phase, so management made the decision to give up a large equity stake to Steve Taylor, Round 13 Capital and a few other strategic investors to come on board.

The private placement, which closed on October 20, 2017, resulted in the company issuing 19,999,992 units at $0.05 (comprised of one common share and one share purchase warrant at $0.05 for 24 months) and 4,444,441 units at $0.0675 (comprised of one common share and one share purchase warrant at $0.0675 for 24 months), for gross proceeds of $1,300,000. We participated in that financing. Our understanding is that all the shares from the private placement were placed in very strong hands and should not flood the market once the private placement becomes free trading.

Share Structure and Insider Ownership

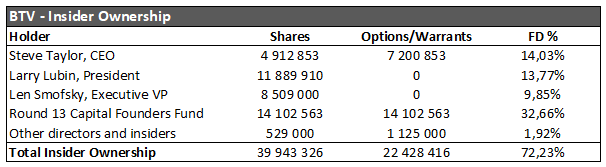

Here is an overview of BlueRush’s share structure and insider ownership. It takes into account all shares, warrants and options issued and announced in press releases up to December 13th, 2017.

As you can see in the insider ownership table, most of the warrants and options are held by management and insiders (76% actually). The rest is in friendly hands as the last private placement was split between only a handful of strategic investors. As a side note, one of the company’s customers participated in a small way in the private placement. When the customer likes the product so much that he wants to invest in the company, this is something we like to see!

Financials

Although it is usually helpful to take a look at past financial results, in BlueRush’s case we are much more interested in the pipeline of new SaaS products than the legacy digital marketing services. For that reason, we will mostly focus on future projections and let readers assess past financial performance on their own.

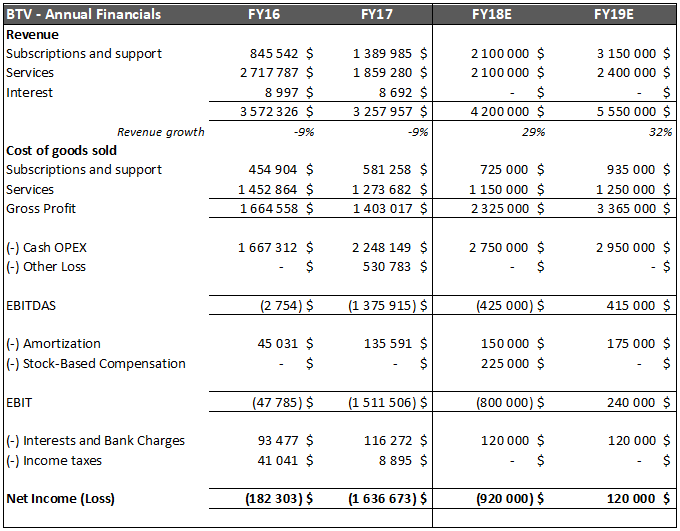

We often hear that valuing companies is more art than science. Well for BlueRush, it’s a lot of art and little science. Financial data for new products is limited, expenses have been reduced on the services side while new expenses are being added on the SaaS product side, including 5 new sales people and a paid search campaign to accelerate lead generation. There are a lot of moving pieces here, so be careful when doing your due diligence (or relying on our estimates). Nevertheless, here are our projections for FY 2018 and 2019 (note that BlueRush has a fiscal year ending on July 31st):

The key assumptions in the above model are the following:

- Subscriptions and support revenues (SaaS products and hosting) will grow a little over 50% per year for the next 2 years.

- Services revenue will grow slowly and stabilize at $200,000 per month in FY 2019, according to management’s projections.

- Gross margins are a key input and are tough to model on Subscriptions and support because there is a blend of SaaS revenues (90% GM) and hosting (very low GM). We have modeled an improvement on this segment from 58% GM in FY17 to 70% in FY19 as more SaaS revenues are added compared to hosting.

- Cash OPEX is also tough to model and will likely need to be adjusted when the next couple of financial statements are released.

Based on our discussions with management, we believe the company could reach profitability in approximately 18 months, which gets us to Q4 2019 (May-July 2019). However, we wouldn’t expect profitability to be management’s main focus. When a SaaS growth company gets its metrics right (Customer Acquisition Cost lower than the Lifetime Value of a customer, and decent payback period), it is often much more valuable to keep spending and grow faster rather than try to be profitable.

Valuation

As many of our readers know, profitability (or near profitability) is one of our important investment criteria. BlueRush is thus a company that we wouldn’t typically look at or invest in. What happens here is that we believe so strongly in the new CEO’s vision and in the team he has put in place that we are willing to take a little more risk.

When we evaluate a SaaS business that is not profitable, there are 4 main criteria we play close attention to:

- How fast are revenues growing? In FY17, recurring revenues grew 64% over the previous year and management plans to keep growing over 50% per year. We can happily check this box for now.

- Is the balance sheet healthy or will the company run out of cash? With the latest private placement, the company has over $2M in cash. Additionally, all the warrants are well into the money and could yield another $1.3M in cash. With over 2 years of runway with the current cash position, we feel very comfortable.

- Is management competent? Steve Taylor, the new CEO, was appointed very recently. Based on our discussions with him and his track record, we believe he is highly competent and are very excited that he came on board. Just because we have not seen him as CEO of a public company previously, we will be cautiously optimistic and look for signs that our thesis is right over the coming quarters.

- Does management have a history of raising capital successfully? The last private placement was largely oversubscribed and brought in some strategic investors. Round 13 Capital, which now owns a significant equity stake in the company, will most likely support the company until a potential exit a few years down the road. Raising additional capital should be fairly easy for BlueRush.

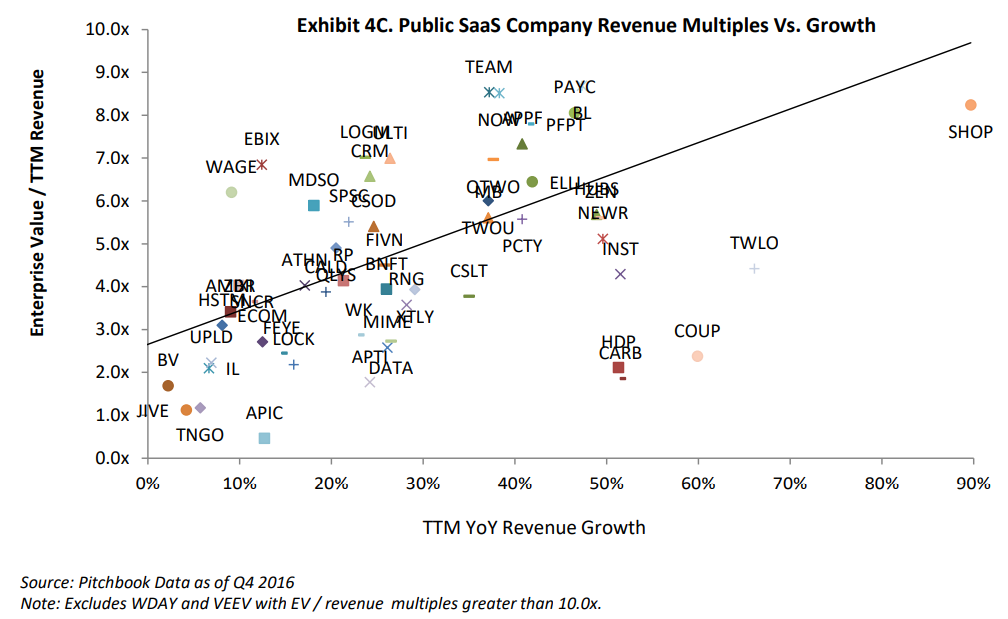

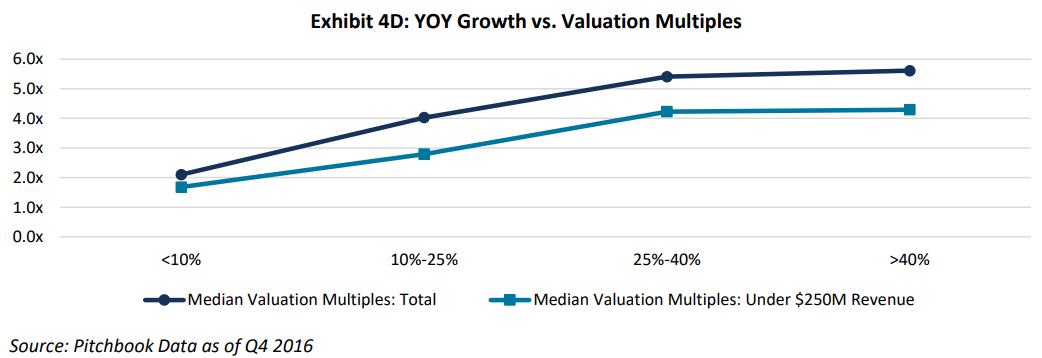

Now let’s get into the valuation. Since many SaaS companies are not profitable, there is no way to value them based on profitability metrics such as P/E or EV/EBITDA. The most common and convenient multiple that is used is a multiple of sales. A 2017 valuation benchmarking study for SaaS companies was published by River Cities Capital Funds, and here is what it shows about public SaaS company valuations:

There are a few takeaways from the two exhibits shown above:

- Few companies trade below 2.0x revenue. Slow growth (<15%) and balance sheet issues might explain why some do.

- In the 25%-40% YoY growth range, which is where we think BlueRush fits, the median valuation multiple is 4.0x revenue.

- Some companies in BlueRush’s category can trade as high as 8-9x revenue, but those would likely represent the most mature companies.

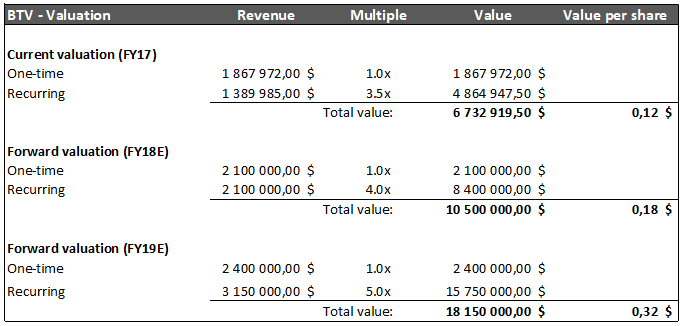

We have decided to breakdown BlueRush’s revenue into two categories: recurring and one-time. One-time revenue will be given a multiple of 1.0x, while recurring revenue will be given a multiple of 3.5x for the current valuation, a small discount compared to its peer group’s median because BlueRush is still very small and early stage.

If BlueRush is able to achieve the revenue growth targets it has set out, we believe that the recurring revenue multiple should improve from 3.5x to 5.0x in FY19. We see a potential for BlueRush’s shares to go from $0.12 to $0.32, or 167% potential return, over 2 years.

Key points here are:

- We believe that BlueRush is undervalued. The current $0.12 share price only reflects past performance and gives very little credit to the recent fundamental developments (new management, new sales strategy, addition of strategic investors, etc.)

- Our future projections only include organic revenue growth, mainly from DIGITALREACH and INDIVIDEO. Monetization of other IP assets and/or acquisitions could provide additional upside to our forecasts.

- The ”value per share” calculation is done using current basic shares outstanding. It doesn’t account for potential dilution, debt and excess cash. We encourage readers to make their own assessments of future dilution and cash burn to arrive at an estimate of the value per share in FY18 and FY19, using Enterprise Value instead of basic market capitalization.

Risks

- Short track record with SaaS products, which means that revenue growth is hard to predict and could disappoint. Slower revenue growth would clearly impact negatively our assessment of the company’s intrinsic value.

- The company faces competition from very well funded competitors. There have been significant amounts of venture capital money invested in the space lately, which makes us think that the VC community likes the space and sees the same upside as we do. However, there is no assurance that BlueRush will come out on top.

- The company is not profitable and may need to raise additional capital in the future, on terms that might not be favorable to current shareholders.

- The stock is very illiquid and could be hard to sell in unfavorable circumstances.

- Short term price volatility due to potentially weak Q1 2018 results. Since this quarter was the last one under previous leadership, our expectations are very low. Share price weakness could present an attractive buying opportunity.

Potential Catalysts

- Improved revenue growth starting in fiscal Q2 2018 (November 2017 – January 2018), following the implementation of new business development strategies by CEO Steve Taylor.

- Monetization of some hidden IP assets, such as the Mortgage Expert or Retirement Expert tools.

- Partnership with the US division of Broadridge to enter the US market with SMARTADVISOR.

- Acquisitions of companies with complementary product offerings

- Discovery of the company by investors. As of now, the company does almost no press releases, doesn’t have an investor presentation on its website and has spoken publicly to investors only one time in the last few years, which was at our Espace MicroCaps December Cocktail event in Montreal. We believe the company is extremely under the radar.

Conclusion

Investing in profitable, or close to profitable companies is one of our golden rules. However, rules are made to be broken sometimes. We believe so much in the team at BlueRush that we are willing to place a bet on management for a few years, and let them create value through substantial revenue growth instead of profits. This is not without risks, but we like our chances when we invest alongside smart money such as former dragon Bruce Croxon!

Disclosure: Philippe and Mathieu are long shares and warrants of BlueRush Media Group (BTV.V)