Brandon Mackie |

The Simple Tool You Need to Beat the Markets

This article is a collaboration with SmallCap Discoveries. Founded by Paul Andreola and Brandon Mackie, Smallcap Discoveries is a paid newsletter dedicated to the discovery of the most promising emerging companies in Canada. Their methodology has enabled them to identify and invest profitably in some of the best-performing stocks in the Canadian market during the last couple of years. Their style is simple but effective — invest early on in discovery at unreasonably low prices and sell to institutions much later in the process for several times their cost base.

Becoming a member brings many interesting benefits, including privileged access to Paul and Brandon on their forum and exceptional private placement opportunities. Become a member today by visiting the Smallcap Discoveries website.

Atul Gawande’s breakthrough book, The Checklist Manifesto: How to Get Things Right, begins with a nightmare story.

A mother and father had taken their three-year-old daughter out for a walk in the icy swiss alps. They took their eyes off her for a moment, only to watch her fall into a freezing lake.

By the time they pulled her body out, she was completely lifeless. Her body temperature was just 66 degrees. They rushed her to a hospital where a group of doctors attempted the impossible: bring the young child back to life.

Organ-by-organ, the doctors worked furiously to revive her. First her heart, then her lungs, and then finally – 2 weeks later – her brain. She started to breathe again, and then one day, she awoke on her own. By age 5, she had made a complete recovery.

And so, Atul wondered, how could the doctors have pulled this off? Each step alone is enormously difficult and complex. Not to mention each step had to happen in perfect sequence and harmony.

One mistake and the girl dies.

Atul researched the process used at this and other top hospitals. And the surprisingly simple answer he found was….

A checklist.

Yep, the same sheet of paper you might see used for a bathroom cleaning apparently has the power to revolutionize everything from medicine and airlines – all with shockingly good results.

And so we – and many other investors – wondered… could a checklist improve our investment results?

Could this simple tool help us avoid big losers and become more consistent?

Turns out it can.

And in today’s article, we’ll reveal our checklist and show you how it’s helped us beat the market and find massive winners early – companies like XPEL (DAP-U.V) at $0.17 and Covalon Technologies (COV.V) at $0.13.

Why use a checklist?

The reason to use a checklist is to force consistency on yourself. You want to ensure you are always looking at the same important factors for each investment.

You see, when you first analyze a company, there will always be things that excite you. It could be the top-notch management team or a disruptive model or technology.

That excitement, though, can cause you to overlook red flags hiding in plain sight. Maybe you missed a penny-priced convertible debenture that could dilute you into oblivion? Perhaps there’s a big chunk of debt coming due later this year?

By using a checklist, you are always looking at the complete picture. And by making your process more consistent, you improve your results.

Alright, ready for the checklist? Be warned though it’s nothing fancy…

The Smallcap Discoveries Checklist

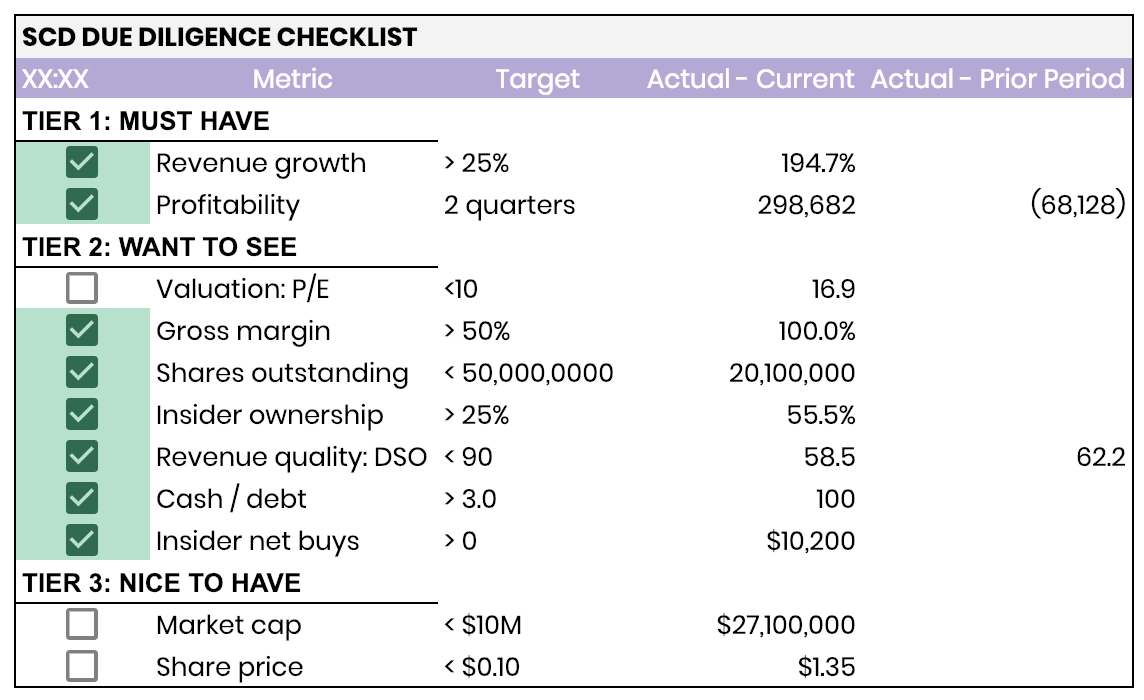

Here it is: our checklist. We’ve applied it here to the most recent company we analyzed for Smallcap Discoveries (to see the ticker, subscribe here and enter the coupon SCDHALF at checkout to save 50% on your first three months):

You have two key things to determine when making your checklist:

- What metrics do you look at?

- How important are those metrics relative to each other?

Not all metrics are created equal. Insider buying is nice to see, but it usually won’t make or break your thesis. But if the company hasn’t turned a profit in a decade, that could spell disaster.

Tier 1: Metrics we must see

The two metrics we must see are revenue growth and profitability. Let’s go through each.

1) Revenue growth

This tells us something is working at the company – could be customer growth, a new technology, or even a better sales process. Regardless of the reason, growth drives valuations and in our experience, it’s the biggest difference between a multi-bagger and a value trap.

We want to see at least 25% year-over-year revenue growth per share – ideally most or all of that growth is organic.

2) Profitability

Profitability is a major milestone for a company. It’s the moment they can start funding the business from operations – and no longer need the capital markets. It proves they have a real, sustainable model and for us, that’s worth waiting for – even if we’re paying much higher prices than early-stage investors.

We want to see at least 2 consecutive quarters of profitability.

Combined, these two metrics tell us we’re buying a real business. Not a story, not a pipedream. The business may falter in the future, but at least we’re starting with a proven company.

These metrics are so important, we’d estimate 80% of investment returns are driven by them alone. Some investors call it too simple – but we obsess over these two numbers.

Okay now that we’re comfortable here, let’s dive deeper into the next section of our checklist.

Tier 2: Metrics we want to see

These are the metrics that complete the story. We don’t need to see all of them hit, but the more the better. Here they are:

3) Valuation

Warren Buffett made billions out of buying cheap, undervalued stocks. The idea was simple – a valuation re-rating could drive returns far more than business performance.

Buying cheap is often your best risk mitigation and we’ve found those stocks with life-changing returns – 10, 20, 30-baggers – all had the combination of high growth and low multiples.

Single digit P/E ratios are the sweet spot for us.

4) Shares outstanding

Is there any difference between a company with 10 million shares out trading at $10 and one with 100 million shares out trading at $1?

In our eyes, yes. A big difference. The share structure tells you about management’s attitude. If they’re savvy operators, they’ll treat their shares like gold – only diluting when the price is right. But if management treats their shares like toilet paper… you best stay away.

The share count helps you understand which side management is on before you invest. We see time and again a low share count predicts a higher likelihood of company profitability. Again, we think this has to do with the culture and attitude of management.

Under 50 million is where we want to be, and 25-30 million has been our sweet spot.

5) Insider Ownership

You want insiders aligned with your interests – and this can only happen if they own a good chunk of shares. Because if not… they might be happy to coast along with a comfortable salary, which does you no good as a shareholder.

We like to see 25+% ownership and a big plus if insiders bought that position with their own money. Be careful though because you can have too much inside ownership… once you get above 50%, you will be at the mercy of insiders.

6) Revenue Quality: Days Sales Outstanding

What’s the fastest way to lose 100% of your money investing in microcaps? Invest in a fraud.

And what do frauds usually do? They inflate revenues.

If this is happening, you’ll see it in the company’s accounts receivable balance (money owed but not collected from customers). If receivables grow much faster than revenues, watch out.

Days sales outstanding (DSO) is a simple metric to monitor the relationship between revenues and receivables. Be careful if you see this metric swell. 90 days is our cut off here.

7) Cash-to-debt ratio

Debt, as Warren Buffett says, is a 4-letter word. It can be great to juice returns but when the market turns (which it always does), it can spell disaster for microcaps.

When a company is cash-rich, they can weather the storm and continue investing in their business even when the capital markets dry up. We like companies that control their own destiny.

Our ideal company has no debt and at least $1 million of dry powder on the balance sheet.

8) Insider buying

Famed money manager Peter Lynch once said: “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

Insider buying is one of the most bullish signals you can have. Even better if it’s coming from multiple insiders, and more than just the CEO. CFO’s are usually conservative types, so if they’re buying, it could be time to back the truck up…

Tier 3: Metrics that are nice to have

These last couple metrics are by no means mandatory, but we’ve found they can signal some of the biggest investment returns. They are all about finding small – really small – companies that are completely undiscovered. Nothing gets us more excited.

9) Market cap

The idea here is the smaller the company, the more room they have to grow – and the more leverage you get as positive business developments are magnified.

Take a small software company doing $1 million per year in revenues. If they land a $500,000 contract (not uncommon), your shares could be worth 50% more overnight – and possibly a lot more with the scale in software.

The other advantage is that most large savvy investors aren’t interested in small companies because it doesn’t move the needle for them. Invest in tiny companies, and you’ll have little to no sophisticated investors competing against you.

Under a $10 million market cap is our sweet spot.

10) Price

Why do large US stocks like Coca Cola (KO) and Apple (AAPL) split their shares once they get over $100? What’s the point if the valuation doesn’t change?

The answer:

Psychology.

Much like a stock feels more expensive over $100, a $0.10 stock just feels really cheap. And that psychology creates room to run once things start going right fundamentally.

Plus with many funds barred from owning stocks under $1, the further below that threshold you are, the more likely it’s undiscovered.

We’re amazed time and time again how many of our biggest winners start around the $0.05 – $0.10 level.

Wrap-up

People often don’t believe that our process and checklists are so simple. But the numbers don’t lie. Since starting Smallcap Discoveries, this process has identified new ideas with an average return of 101.8%.

If you want to see more of the companies we’ve found recently with this checklist, trial a subscription to our service.

CLICK HERE TO SUBSCRIBE and enter the coupon SCDHALF at checkout to save 50% on your first three months.

We think every investor can benefit from systemizing their process and using a checklist. Take what we have here. Or make it your own. That’s the fun of the markets – there is no right or best way to make money.