Brandon Chow |

Why Coronavirus Should Make Microcap Investors Pickier than Ever

Microcap investing is hard. You’re likely to have more losers than winners.

But we know that the name of the game is about finding multi-bagger winners to make up for your losers. However, it’s difficult to accept defeat and many times you shouldn’t have to.

If there’s one thing the COVID-19 pandemic has taught us microcap investors, it’s that we need to be pickier than ever.

The pandemic has brought an unprecedented health and economic toll on people around the world. COVID-19 has threatened the way we do things and has acted as a forcing function to accelerate trends that were starting.

As fossil fuel prices suffers from demand destruction, policy makers are using the opportunity to accelerate the transition to renewable energy.

As restaurants close their doors, companies are taking advantage of the shifting consumer spend to accelerate the transition to e-grocery and home delivery offerings.

As with any crisis, there will be winners and losers. Companies will come out of this crisis stronger than before, but others won’t make it out alive.

Why does this apply to you as a microcap investor?

1. Microcaps have historically outperformed largecaps but this isn’t happening

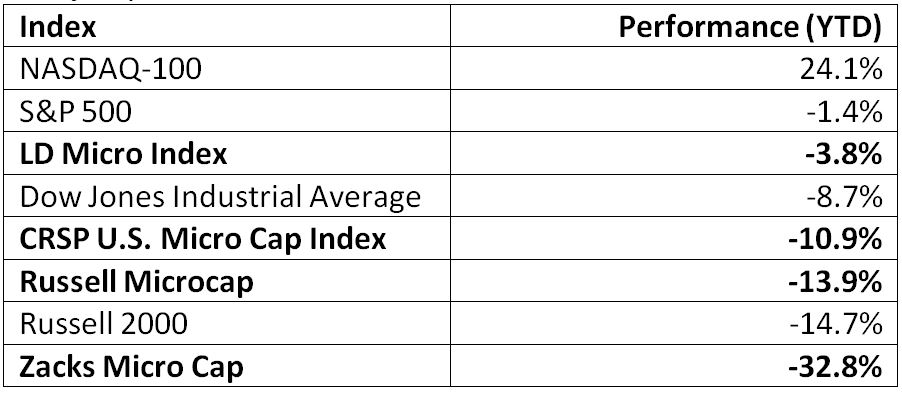

The leading microcap indices (Russell, Zacks, LD Micro, CRSP) have significantly underperformed over the past couple of years compared to their counterpart largecap indices. The COVID-19 pandemic has made this disparity worse.

“Small caps do tend to carry more risk, but they should over time reward investors for taking that risk, meaning they normally outperform over long periods of time.”

– Eric Marshall, President, Hodges Capital

This is further evidenced by Eugene Fama’s and Kenneth French’s small-versus-big index series, which shows that in monthly returns between July 1926 and February 2012, small-cap stocks outperformed roughly 51% of the time. During that time, small-cap stocks also delivered a cumulative excess return of 253% relative to large-company stocks.

However, over the last decade, microcaps and smallcaps have underperformed. This is concerning as we came into the pandemic weaker and this is being exacerbated.

Table comparing microcap indices YTD performance with major U.S indices

As of July 10th, 2020

Why is this happening?

No one knows for sure, but my hypothesis is the following:

- The pandemic has impacted Main Street most. Small businesses across the world make up the bulk of companies seeing the most severe effects of the pandemic.

- Small companies are local and do not have the same resources and geographic diversity of largecaps to spread and hedge risk.

- Investors, in fear of a market crash, are flocking towards “safety” which is thought to include larger companies, with lower volatility, and typically offer a dividend.

- Certain asset classes and industries have become “hot” and investors and traders are flocking to well-known names in pursuit of higher returns.

All in all, in a period of relative underperformance, we need to be pickier about what microcaps to choose because losses will hurt more than they have in the past. Until the sentiment changes, markets will be less forgiving.

2. The pandemic will weed out the weak and has had an asymmetric effect on industries

Many see the pandemic as a forcing function that will reshape how we live and do business. Microcaps are small enough to fail.

Businesses go through natural selection, akin to biology, where they must enter a state of continuous innovation and value creation to stay alive. Survival of the fittest.

This is especially relevant to microcaps which have limited ability to receive government bailouts and support from policy makers.

Some microcaps will go, and others will get their time to shine or be created as a result of new industries developing.

The coronavirus gives investors a chance to think about how we want to rebuild the world coming out of the pandemic. Existing dynamics will disappear, and new opportunities will rise.

For example, it’s clear that issues of sustainability have come to the forefront of people’s minds with the inflows towards Environmental, Social and Governance (ESG) investing. This can be seen as having a transitional effect on fossil fuels.

Some relevant questions you should be asking of your microcaps are:

- Are the companies going to be part of the future I see?

- Are their balance sheets strong enough to weather out the recession?

- Will the industries my companies are in benefit from the pandemic?

- What would make my companies resilient to the aftereffects of the pandemic?

- Can my portfolio companies take advantage of M&A opportunities that will arise?

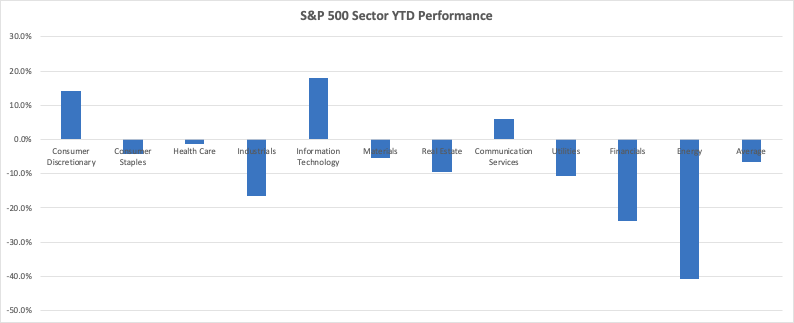

The above chart displays the S&P 500 sectors and their performance YTD. Information technology leads with an 18% gain and energy is lagging at a 40.8% loss. What’s striking is the overall strength of the S&P 500 index (-1.4% YTD) relative to the average of all industry sectors (-6.7%).

List of industries that are hardest hit

This leads us to our last point which is the accelerant nature of the pandemic.

3. Coronavirus is an accelerant and microcap investing fundamentals still hold true

It’s believed that the coronavirus has acted as an accelerant on society. It’s brought to light systemic issues we knew we had to face but haven’t yet. These include record government and consumer debt, long-term care homes, and higher education.

Companies with especially weak balance sheets and rapidly declining revenues will be the first to go. However, in hindsight it is evident that specific companies in poor financial health and threatened business models would go.

Microcap investing fundamentals hold true and now is the time to re-examine how they stack up in the new environment for each of your companies.

Questions to test your microcap investments:

- How essential is the company’s business model?

- Does the company have a low debt load and a robust cash balance? Were they in a healthy financial position beforehand?

- Is the company expensive? Is the valuation justified?

- Have revenue and earnings estimates been lowered?

- Are there strong gross margins that can provide a margin of safety in the event of deterioration?

- Has the company showcased ability to execute well through a recession?

- Are there accretive M&A opportunities that will come forward?

- Does the company need to raise money through capital markets? Can the company raise the money?

Small companies have always had the benefit of being nimble and capable of taking advantage of niches that larger companies don’t see worthwhile.

As we continue to invest for the long-term, much of what we know and have learned remains true and the coronavirus pandemic has helped us see first-hand the catalytic effects of stagnant business models, poor governance, and lack of value innovation.

Coronavirus shouldn’t be a reason to be picky and weed out the junk.

This should always be done and now is the time to be pickier than ever as we’re faced with these unprecedented times.

About The Author

Brandon Chow is your financially savvy millennial, whose microcap portfolio was kickstarted from a six-figure exit of his IT hosting company in high school. Full-time, he is fighting climate change by leading investor relations at Xebec Adsorption (TSX-V: XBC), a Canadian cleantech company. He also aims to educate and inspire millennials to invest in their version of “YOLO” through The YOLO Fund.

Hi,

Thanks for the interesting articles on Micro Caps.

I eagerly read each post.

I hope to walk away learning something new each time.

All the best.

Hi Mike,

That is great to hear and it’s my pleasure to help educate everyone on microcaps!

Regards,

Brandon