Brandon Chow |

6 Free and Easy Ways to Find Canadian Microcap Investments

- Coming up with new investment ideas is one of the most challenging things to do as a Canadian microcap investor

- Investment opportunities are fluid and you are constantly building your watchlist of companies

- We’ve put together a list of six different ways to help you find new Canadian microcap ideas

- All of them are digital and free, making it possible to invest from the comfort and safety of your home

- It’s more important than ever to support the Canadian recovery as we recover from the COVID-19 pandemic

- The time to explore and invest is now as smallcaps have historically outperformed larger companies coming out of recessions

Finding new Canadian microcap investment ideas shouldn’t have to be back-breaking work. The digitization of information and trading has made it easier than ever to add names to your portfolio.

Searching for new Canadian microcap investments usually means digging through the weeds to find what has not yet become mainstream. We hear about the “discovery” process and how that is a significant driver for market-beating returns. Finding a unique company before the masses is a strategy microcap investors deploy and that means building out your toolkit to include the best sources of information you can.

Below are six free and easy ways to find new Canadian microcap ideas:

1. LD Micro Index

The LD Micro Index is one of the most well-known microcap indices out there. It’s useful in aggregating names in North America and gives you an idea of microcap performance relative to other asset classes.

From LD Micro: “The LD Micro Index is designed to give the most accurate representation of the intraday activity of microcap stocks in North America. We employ a mixture of screening for inclusion and manual exclusion where deemed appropriate. The index is market cap-weighted and is comprised of 1,167 stocks in the U.S. and Canada.”

Their list of constituents in the index can be downloaded directly from their website. Here is the list for the period ending September 30th, 2020.

The PDF list is sorted by market cap and a column for the exchange. To find Canadian names, you’ll need to filter by either the “Toronto” or “TSX Venture” exchanges. As of writing this, there were 244 Canada listed microcaps out of the 1,167 companies in the LD Micro Index.

LD Micro companies have to meet certain criteria relating to liquidity and market cap, making it a great list of names to start off with and explore.

LD Micro Inclusion Criteria

- Listed in the U.S. (NYSE/AMEX, Nasdaq, OTCM) or Canada (TSX, TSX Venture)

- Market cap between $50 million and $300 million

- Average daily traded value of $50,000 over the preceding three months

- Filed 10Q or 10K in the preceding calendar year

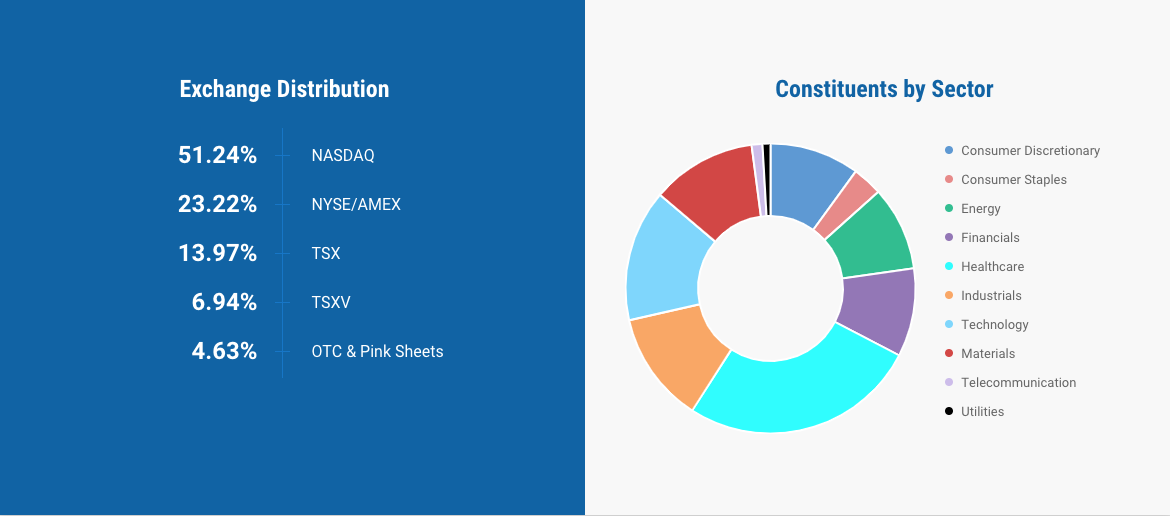

A variety of microcaps are included as shown by the LD Micro’s distribution by exchange and sector

View more details on the LD Micro Index

2. TMX Money

TMX Money is one of the most used tools for researching and tracking Canadian stocks.

Prior to its recent redesign, there were a number of resources available on the website that were helpful to investors. Although the old website is not accessible anymore, we’ll be focusing on it since it can still be accessed through archiving tools and is more useful than the new one that is live today.

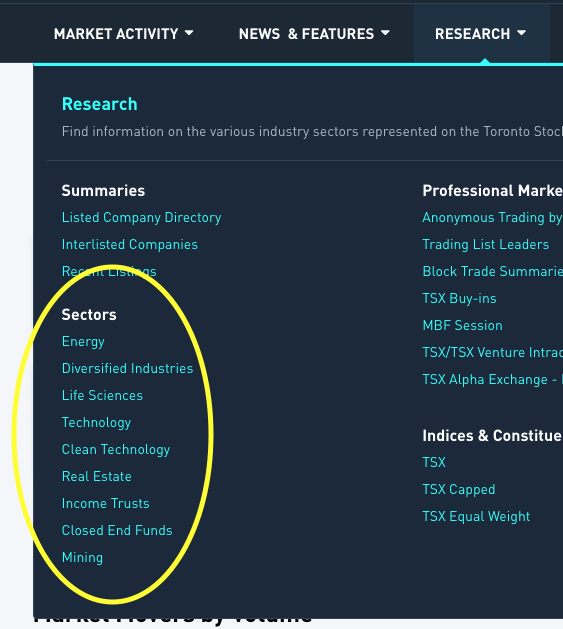

Firstly, we’ll be using this version of the Internet Archive’s Wayback Machine. One especially helpful section is the list of companies by industry, which can be found under the “Sectors” section of the “Research” tab.

Screenshot of the Research tab from the old TMX Money website

Within each sector section, there is information on the sector as it pertains to the exchange. Embedded in the lower part is a link to download an excel sheet of all the TSX and TSXV listed companies in the sector.

What is helpful about this excel sheet is that it comes with a number of stats, which also includes market cap that you can use to sort by and as a filter for non-microcaps.

Example: Download a list of technology and innovation companies that have listed with us on TSX and TSX Venture.

We encourage you to spend the time going through TMX’s tools, as they can offer a vast amount of information that may be overlooked by others.

3. Online Investing Communities

Canada has a number of DIY retail online investor communities. These can be a treasure trove of information as it’s common for investors to share their analysis, insights, and information on companies they are following. Many times there are constructive conversations that can help you learn about new companies and better understand them.

As microcap investors, many times we are relying on the insights of others to support our research. Below are a number of communities to explore:

RedFlagDeals

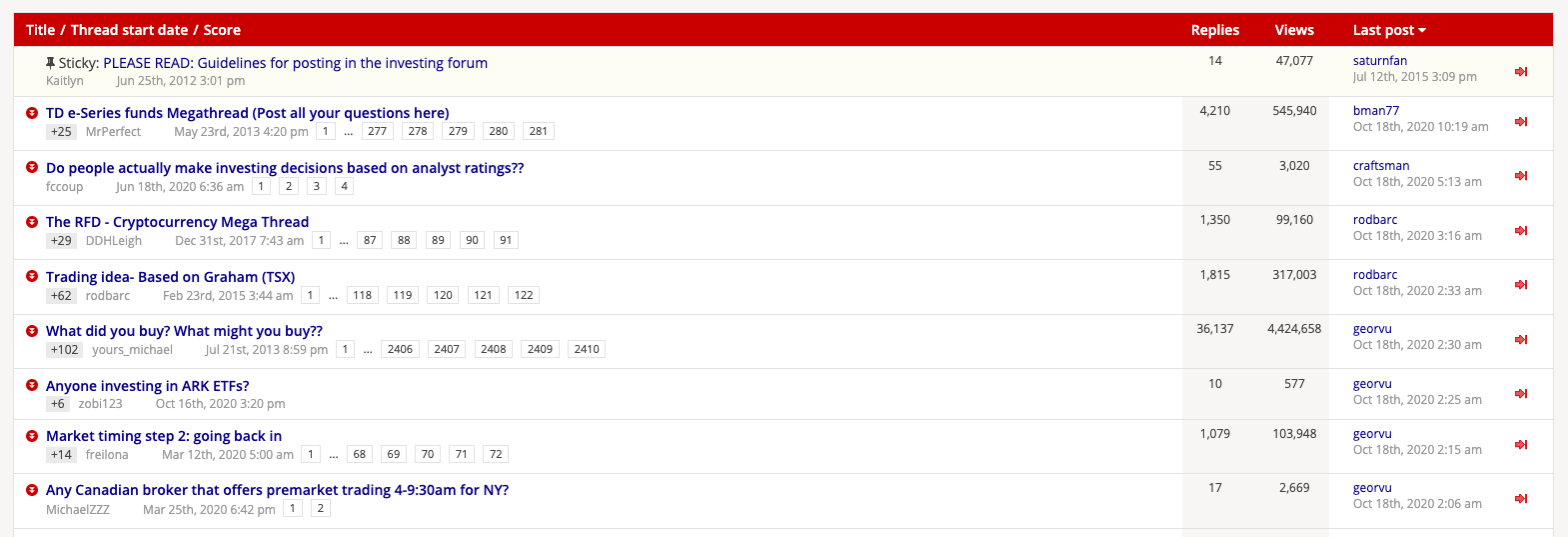

As weird as it may be, there’s a decent amount of personal finance discussion on Canada’s largest bargain-hunting website. Buried in the forums is an investing sub-forum where bargain hunting changes from groceries to stocks. Although not specific to microcaps, there’s a number of discussions you can start off to explore which can include them such as:

- What did you buy? What might you buy??

- Canadian Small caps and Penny stocks

- Official Penny Stock Day Trade / Short Term

As with any of the communities shown, there is nothing stopping you from creating a thread and starting a conversation about microcaps and collecting feedback.

RedFlagDeal’s Investing subforum showing thread discussions of various topics

Silicon Investor

Silicon Investor is an old favorite. It’s where a number of prolific microcap investors started building a following, including Paul Andreola from SmallCapDiscoveries. The website offers a specific section for microcaps and a thread dedicated to Canadian ones. It’s not as active as it once was, but its history offers good learning and timeless principles for investing.

r/CanadianInvestor

This Reddit subreddit is another example of one not specific to microcaps but does have the occasional content on it. You can frequently find posts relating to Canadian microcaps and the value here is being able to get an engaged discussion on one.

In addition, a useful feature of the subreddit is the daily discussion where you can find other Redditors commenting on news releases and it will sometimes be from a microcap. There are other investing subreddits, but the amount of Canadian specific microcap content will be lower.

Espace MicroCaps

The last one of our communities is the Espace MicroCaps forum. Mainly targeting a French-speaking audience, it does a great job of organizing companies in separate threads where responses are listed in chronological order. The curation and contribution level of the posts is of a higher quality than other online forums and thanks to the guidelines set by its founders Mathieu Martin and Philippe Bergeron-Bélanger.

4. Newswire Newsrooms

Next up on our list is newswire services, which can help you track news coming from Canadian issuers. Each newswire service has a newsroom that companies are obligated to send official press releases through such as contracts, financings, disclosures, etc.

It’s a solid way of finding material events that could be transformative to a company. Here is a list of newswire services and their newsrooms:

- Business Wire Newsroom

- GlobeNewsWire Newsroom

- ACCESSWIRE Newsroom

- Newsfile Newsroom

- TheNewsWire Newsroom

- Cision Newswire Newsroom

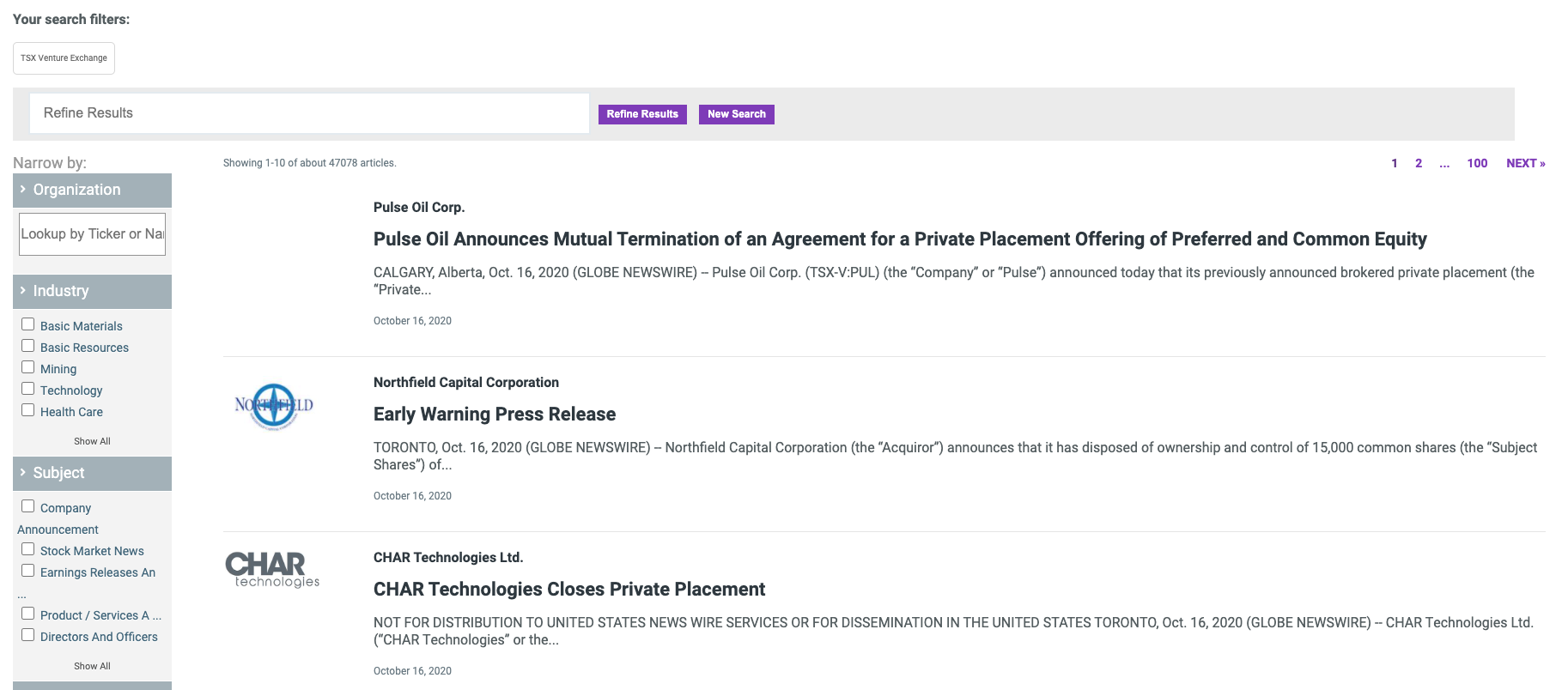

The key to finding Canadian microcaps is to search for the exchange filter for “TSXV” or “TSX” to narrow down your results to companies listed on those exchanges. If an exchange filter is not available, then searching for the tickers will also bring up results.

Search results from GlobeNewsWire showing news releases filtered by the TSX Venture Exchange

5. Stockhouse

Stockhouse is the most active community today for Canadian smallcap investing. The most active members in the community are present here sharing their due diligence and actively engaging in the “bullboards’’ of their favorite companies.

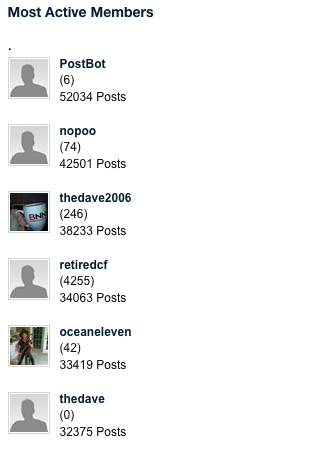

Simply following the most reputable posters, you’ll get a list of companies they have vetted based on their activity and post content. One place to find this is by looking at the “Most Active Members” list here.

List of the Most Active Members on Stockhouse

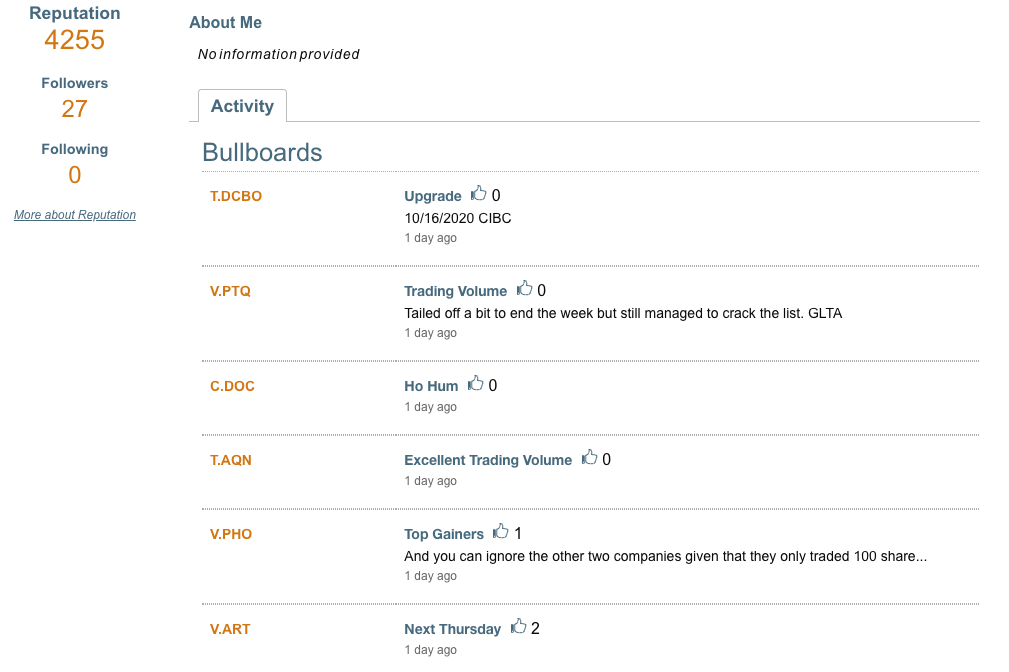

Activity for one of the Most Active Members, retiredcf, and their post history showing a number of Canadian microcap tickers

Stockhouse’s “Most Active Members” is a quick and easy way to monitor the favorites of these active posters and from there, you can dig deeper into other posters to find new ideas. There are a plethora of options to discover new companies on Stockhouse, which includes looking at lists of the most active bullboards, featured news links, blogs, etc.

One of the regular lists published on the most active bullboards on Stockhouse for Industrial stocks

6. Canadian Microcap Influencers

Next up is exploring some of the most popular influencers in the microcap space. Influencers in the Canadian microcap space are just as sparse as the number of indices that include them. It’s a tight-knit community and for better or worse, word spreads quickly when you (under)perform.

These influencers typically leverage their own or other’s platforms to spread the word about microcap investing and their top picks.

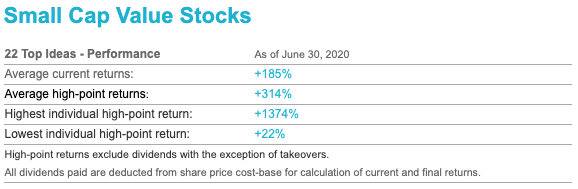

First up is Gerry Wimmer from Investorfile, who has been writing about small cap value stocks for more than two decades now. He’s published his list of top ideas on his website, where he writes and showcases the rationale for selecting companies into his portfolio. The performance on his picks is impressive and he’s one of the few who makes his picks and results accessible to everyone. Many times holdings are hidden behind an opaque fund structure or a paid newsletter.

Highlighted stats from Gerry Wimmer’s Top Ideas

Another name to look out for is David Barr from PenderfFund, who is President, CEO and Portfolio Manager of the firm. Mr. Barr manages the prolific Pender Small Cap Opportunities Fund and you’ll often find him discussing portfolio holdings. You can view the current holdings and commentary on the PenderFund website. As of writing this, the top Canadian microcap holdings in the fund included: ProntoForms Corporation (PFM.TO), Sangoma Technologies Corporation (STC.V), Alcanna Inc. (CLIQ.TO), MAV Beauty Brands Inc. (MAV.TO), and Diversified Royalty Corp. (DIV.TO).

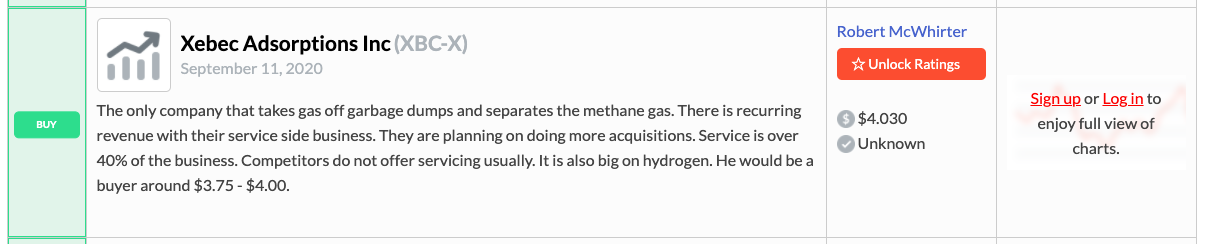

Another source of influencers is BNN Bloomberg, Canada’s largest financial news TV channel. There are dedicated segments for smallcaps where viewers call in about companies and these influencers provide their top picks. In addition, a good way to monitor their picks and sentiment on stocks is through a tool called Stockchase.

We’ve listed several names in the space with a link to their Stockchase profile:

By following these influencers over time, you’ll get a better understanding of how they think, their performance and you can use the outlets they are on as a means for partial vetting and curation.

A comment from Robert McWhirter on a BNN Bloomberg episode on Stockchase.com where he speaks about Xebec Adsorption (XBC.V)

Conclusion

Building a Canadian microcap portfolio isn’t easy, as there are thousands of options to choose from. Discovery is the first step in this in which there are many ways to find companies, six of which were discussed in this article.

The digital age we live in has made it accessible to everyone for discovering the next multi-bagger. The individual retail investor is more empowered than ever to invest by themselves and build active portfolios that rival the returns of professionals.

These six ways represent a small sample of methods you can add to your microcap discovery toolkit. We encourage you to continue exploring, and hopefully you’ll find unique ones of your own.

About The Author

Brandon Chow is your financially savvy millennial, whose microcap portfolio was kickstarted from a six-figure exit of his IT hosting company in high school. Full-time, he is fighting climate change by leading investor relations at Xebec Adsorption (TSX-V: XBC), a Canadian cleantech company. He also aims to educate and inspire millennials to invest in their version of “YOLO” through The YOLO Fund.

Disclosure

Espace MicroCaps contributor Brandon Chow owns shares of Xebec Adsorption (XBC.V) and is employed in investor relations by the company.