Mathieu Martin |

Espace MicroCaps Top Picks: Boardwalktech Software (BWLK.V)

The company reports its financial results in USD. However, the amounts mentioned in this text are in Canadian dollars (CAD) unless otherwise noted.

Share price: $0.89

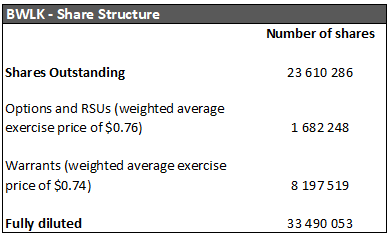

Shares Outstanding / Fully Diluted: 23.6M / 33.5M

Market Cap: $21M

Fully Diluted Enterprise Value: $29.5M

Highlights

- Boardwalktech operates on a Software-as-a-Service (SaaS) model with more than 60% recurring revenue and gross margins of over 85%.

- Patented software used by more than 20 Fortune 500 companies.

- Strong sales pipeline offering short- and medium-term catalysts.

- A private placement is currently underway. This will eliminate high-interest debt and provide the capital necessary to execute the growth strategy.

- Experienced management team with 43% insider ownership.

Company Description

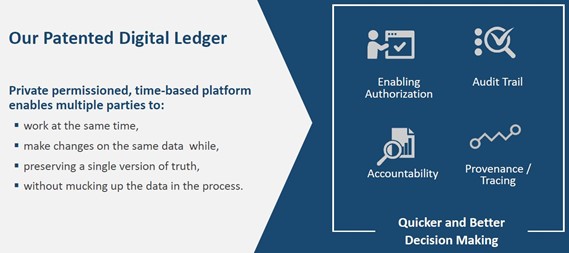

Boardwalktech Software (“Boardwalktech”) has developed a patented Digital Ledger Technology Platform used by Fortune 500 companies running hundreds of live mission-critical applications worldwide.

Boardwalktech’s patented digital ledger technology and its unique method of managing vast amounts of structured and unstructured data is the only platform on the market today where multiple parties can effectively work on the same data simultaneously. Boardwalktech can deliver a collaborative purpose-built enterprise information management application on any device or user interface with full integration with enterprise systems of record in a fraction of the time it takes other non-digital ledger technology-based applications.

Boardwalktech is headquartered in Cupertino, California (Silicon Valley), with offices in India and operations in North America.

For a full investor presentation by the CEO, you can watch this webinar: Youtube – Virtus Advisory Webinar Series – Boardwalktech (TSXV: BWLK)

The Problem

Currently, over 80% of the world’s data is unstructured, which means it is not organized in a predefined manner. Examples of unstructured data are PDF, HTML, Word, and Excel files. Managing and using this information is crucial to help businesses make better and faster decisions.

Today, despite the availability of many business management software such as SAP and Salesforce to organize data, much of business data still ends up in Microsoft Excel.

Some Excel spreadsheets combine data from multiple sources and require the collaboration of numerous users who enter data manually. Executives then use these spreadsheets to make important business decisions.

Unfortunately, these leaders often don’t have all the information they need to make the best decisions possible. Decision-making processes are slower, and this generates additional costs.

Boardwalktech’s Digital Ledger platform addresses these issues by reconciling structured and unstructured company data, enabling collaboration between different departments, increasing efficiency, and improving the quality of decisions through data analytics.

For an overview of how the platform works in Excel, the following video offers a short demonstration: Youtube – Secure Contract Management Collaboration

Business Model

Boardwalktech markets its technology platform using a Software-as-a-Service (SaaS) model (i.e., through a recurring subscription for access to the software in the cloud). The company also generates professional services revenue for implementing and customizing or developing new applications for individual customers.

Since this is enterprise software, the sales cycle is approximately six to nine months, followed by an implementation and training cycle that lasts about six weeks.

Recurring SaaS-type revenues generate gross margins of around 90%, while professional services provide about 50%. Longer-term, Boardwalktech wants to develop channel partners who can take care of sales and implementation, while Boardwalktech focuses solely on technology development and high margin recurring revenue.

Despite its small size, the company enjoys excellent credibility with well-known clients such as Ernst & Young (biggest client), Coca-Cola, Apple, Verizon, Levi’s, Mars, etc.

Growth Potential

The company classifies its growth opportunities into three broad categories:

- New customers.

- Existing customers who develop new ways of using the technology within their business, thereby increasing their use.

- Price increases through the addition of new features and capabilities.

Boardwalktech currently generates US $3.7M in annual recurring revenue (ARR) and publicly discloses that its sales pipeline is close to US $8M. This pipeline is highly qualified and comprises prospective customers who have shown serious interest in the software. According to management, it is estimated that about 60% of the pipeline ultimately converts to sales on average, suggesting the potential to more than double recurring revenues in the short to medium term.

Management Team

CEO Andy Duncan is an experienced entrepreneur who founded four technology companies in the past, 3 of which were ultimately sold successfully. Andy joined Boardwalktech in 2007 when the company was looking for a new CEO.

By his own admission, the technology developed by Boardwalktech was far ahead of its time and the market was not ready to embrace it, which is why the company still has such a small revenue base years later. However, with the meteoric growth in the amount of unstructured data in businesses worldwide, and few solutions that meet the precise needs addressed by Boardwalktech, Andy is now seeing the momentum accelerate.

I also had the opportunity to meet the CFO virtually, Charlie Glavin, who appears to be very competent. He has over 25 years of experience in the finance industry, working for public companies, and was involved in over $5 billion in transactions during his career.

Why Does This Opportunity Exist?

Boardwalktech has been public on the TSX Venture since June 2018. At that time, Canada was experiencing a speculative bubble in the blockchain technology and cryptocurrency sector. Boardwalktech, with its blockchain-like Digital Ledger technology, saw an opportunity to raise capital on extremely favorable terms.

Management decided to go public on the Canadian market by raising $10 million at $5.25 per share. As the speculative bubble burst at approximately the same time, Boardwalktech was dragged down by investors who (wrongly) associated the company with cryptocurrencies. The stock quickly lost over 90% of its value.

Despite the drop in the stock price, the company continued to execute its business plan and improve its fundamentals. I think the company is still very poorly understood by investors today, which creates the investment opportunity.

Financial Performance and Share Structure

Boardwalktech currently is in a less desirable financial situation than the companies typically profiled on Espace MicroCaps. The company is not generating positive cash flows yet, and its balance sheet includes high-interest debt (US $4.5M at 14.95% interest rate). However, these obstacles are surmountable.

In terms of debt, the lender is SQN Ventures, a venture capital fund that has supported the company for many years. SQN is also a significant shareholder in the company, owning over 20% of the outstanding shares.

On January 7th, Boardwalktech announced a $5M private placement, which was subsequently upsized to $8M due to strong demand. The private placement consists of issuing 11.43 million units at $0.70, each unit being comprised of one share and one-half warrant at $0.90 valid for two years.

This financing is expected to close by the end of January and will allow the company to repay most or all the SQN debt. The company will mostly use the balance to increase investments in sales and marketing.

The debt has been a significant risk in the past, and I think this financing is an important catalyst for the stock.

In terms of cash flows, the company has reduced its EBITDA loss from US $3.2M in 2019 (fiscal year ended March 31, 2019) to US $2.6M in 2020 and is expected to lose less than US $1.3M in 2021 (ending March 31, 2021). The company has rationalized its operating costs and, in combination with the expected revenue growth, should start generating positive cash flows in calendar 2021 (fiscal year 2022 for the company).

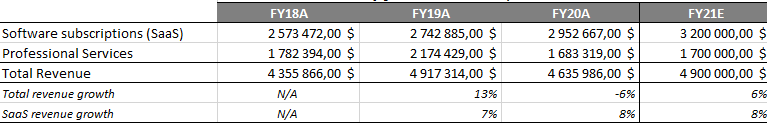

Revenue growth, however, has been unimpressive in recent years:

While past numbers are far from being exciting, there appears to be an acceleration in the company’s sales pipeline, which portends strong revenue growth to come. In the last quarterly financials press release last November, management already hinted at the growth to come shortly, mentioning that “the Company projects ARR to be over $5 million by Q1-FY22” (which means by April 2021).

With the private placement expected to close shortly, Boardwalktech will also have the resources to hire staff to support this growth.

According to management, an exciting opportunity is shaping up in the banking industry. Banks must put stringent risk reduction and compliance processes in place, which they sometimes struggle to do correctly. As an example, Citigroup recently received a significant sanction for its risk management processes: Citigroup fined $ 400 million for risk management deficiencies. Boardwalktech’s software could fix several issues for Citigroup, making it a potential customer, just like many other banks.

Finally, here is the company’s share structure:

N.B: This table does not consider the private placement currently underway.

Valuation

Currently, Boardwalktech generates US $3.7M in ARR, resulting in a valuation (at the current price of $0.89) of 6.2x recurring revenue. On total sales (including professional services), the company is valued at 4.7x the expected 2021 revenue. While I cannot say this valuation is cheap based on past growth trends, I think it is very reasonable given the future growth potential.

Based on management’s comment of reaching US $5M in ARR by April, the EV/ARR multiple could quickly go down from the current 6.2x to 4.6x. Let’s then look at the future potential.

As an example, if the company succeeded in converting 60% of its US $8M pipeline into customers, total revenue (most of which is recurring) would increase to about US $9.7M and the valuation would be a meager 2.4x revenue multiple. In such a scenario, I believe that a more realistic multiple for a company with such a growth profile would be anywhere from 6x to 10x revenue. The upside scenario would be a share price of $2.25 to $3.75, or 153% to 321% return from the current price.

With microcaps, everything always takes longer than expected and I could be wrong on the amount of new business the company will get or the timing. That being said, there is room for error, and I believe Boardwalktech could be a great investment even if sales don’t ramp up as much or as quickly as I expect.

Potential Catalysts

- Significant new customer/contract announcements.

- Strong revenue growth in the coming quarters and reaching profitability.

- Closing the current private placement and paying back most or all the debt.

- Discovery by the market and improvement in the valuation multiples.

Risks

- The company is not profitable and may not become profitable in the short term, requiring further funding in the future.

- Although large companies currently use the software, its adoption remains limited at this time. The anticipated growth may not materialize as expected.

- The company’s largest customer accounted for 47% of revenue for the past six months.

- Enterprise software used by large companies typically has long sales cycles. This can make it challenging to judge the company’s progress in the short term.

Disclosure

Mathieu Martin, the president and sole owner of Espace MicroCaps, is employed by Rivemont Investments (“Rivemont”) as an analyst for the Rivemont MicroCap Fund (the “Fund”).

Mathieu Martin is involved in the decision-making and recommendation process regarding whether the Fund should buy or sell individual securities. Mathieu Martin is also a unitholder of the Fund.

As of January 19th, 2021, the Rivemont MicroCap Fund holds a position in Boardwalktech Software (BWLK.V) and intends on participating in the private placement currently available. This position is subject to change without any notice, at the Rivemont MicroCap Fund portfolio managers’ sole discretion.

Mathieu Martin does not own Boardwalktech Software (BWLK.V) securities personally.

This article is neither an offer to sell nor a solicitation of an offer to purchase securities and should not be considered legal, tax, financial, or investment advice. Several estimates and assumptions have been used in the writing of this article. Espace MicroCaps does not guarantee the validity of the information presented.

Espace MicroCaps is not responsible for direct or indirect trading losses caused by the information presented on this blog. Everyone is advised to make their own analyses and inquiries and consult their own professional advisers regarding legal, tax, accounting, and other matters relating to the acquisition, holding, or disposition of an investment.

Hi Mathieu, very interesting idea. For your revenue estimate of $9.7, are you taking into account annual churn? I believe CEO presented a slide saying their retention is 80%. Replacing 20% of revenue every year isnt that easy, and that is assuming that they do not lose their biggest customer?

Hi Michael, thanks for your comment! This slide is a bit misleading (and I told management about that) because the 80% retention rate is for all the clients they ever had. I’m not sure how that would translate to annual churn, but I believe it would be low single digits. This is a very sticky solution.

Great thanks! Very intriguing idea. Has management mentioned a revenue retention number? Based on the previous revenue growth, maybe it isnt very high.

So, does that suggest that almost all the sales backlog is from new customers, rather than expanding customers?

I don’t really know what is included in the sales pipeline, but I would think this is mostly new customers yes.