Philippe Lapointe |

Espace MicroCaps Top Picks: Microbix Biosystems (MBX.TO)

All figures are in CAD

Share price: $0.64

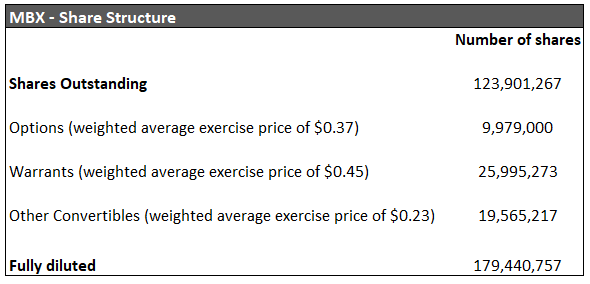

Shares Outstanding / Fully Diluted: 123,901,267 / 179,440,757

Market Cap: $79.3M

Fully Diluted Enterprise Value: $96.9M

Overview

Microbix Biosystems (MBX) was founded in 1988 and has historically been a low-growth company in the antigen business. However, in 2017, MBX appointed Cameron L. Groome as CEO, who saw the potential to use MBX technologies for new use cases. He then encouraged the development of two new divisions, Quality Assessment Products (QAPs) and Viral Transport Medium (VTM), that are now starting to generate significant revenue growth as innovative, proprietary, and branded products.

Highlights

- Proven business model and expertise in the highly regulated diagnostics industry, creating high barriers to entry.

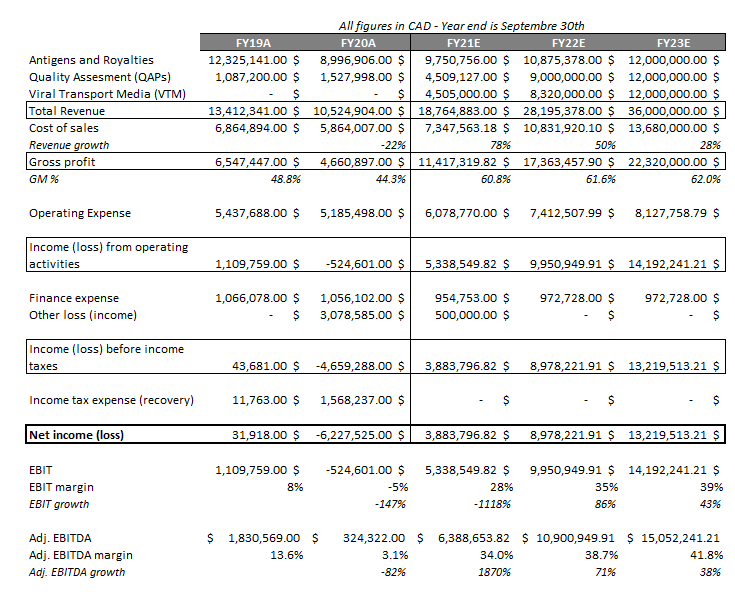

- Forecasted organic revenue growth of 78% in 2021 and another 50% in 2022.

- EBITDA margin expansion from 3%-13% historically to over 35% going forward.

- Potential upside of 90%+ in the stock price within the next year.

Who is Microbix Biosystems?

Microbix develops proprietary biological technology solutions for human health and well-being. It makes a wide range of critical natural materials for the global diagnostics industry, notably antigens for immunoassays and its laboratory quality assessment products (QAPs™), which support clinical lab proficiency testing, enable assay development and validation, or help ensure the quality of clinical diagnostic workflows.

Microbix also applies its biological expertise and infrastructure to develop other proprietary products and technologies, most notably viral transport medium (VTM), to stabilize patient samples for lab-based molecular diagnostic testing. At present, VTM is primarily used for the mass COVID-19 testing.

Microbix is ISO 9001 and 13485 certified, FDA and Health Canada approved, and supplies CE approved products in Europe.

Here is an overview of the three main divisions:

Antigens for Immunoassays

An antigen is a biological substance used in diagnostic tests to determine whether a person is positive or negative for prior exposure to, or immunity from, a disease. The Company provides antigens to international diagnostics manufacturers by growing, purifying, and inactivating real bacteria and viruses for use as antigens. MBX is the critical supplier to more than 100 global makers of tests for infectious diseases. Antigens are the company’s core business and have historically generated most of the revenue. Going forward, the company is adding new divisions so this lower growth business segment should be outpaced by higher growth business lines.

In terms of growth potential for this division, the management team forecasts an organic growth of 5% to 15% per year. The market for viral antigens was US$101.41M in 2019 and is projected to grow to US$236.80M in 2027, an 11% CAGR. Further growth is likely to come from the adoption of public health-oriented immunoassays in new regions, such as Asia-Pacific nations. The markets in which MBX is already operating are more mature (USA and Europe), but the Company could produce modest growth by expanding relationships with established diagnostics clients.

Antigen sales were negatively impacted in 2020 due to reduced testing for non-pandemic-related diseases. The Company anticipates that this business line will rebound to pre-pandemic levels across 2022 ($12M revenue per year). This division is poised to benefit from the post-pandemic return to increasing infectious disease testing and Microbix-specific tech-driven margin expansion. In the past years, Microbix invested heavily to improve and automate its manufacturing capabilities, which should positively impact margins and allow the company to produce more at a lower cost. Gross margins have historically been in the 40% to 50% range for this division.

Quality Assessment Products (QAPs)

Quality Assessment Products are inactivated and stabilized samples of a pathogen or an analogue to a pathogen, that are created and formatted to resemble patient samples. Clinical labs need to use such test controls to help ensure that their testing programs are accurate. For example, a lab may use controls every 100 tests. They will input known positive and negative test control samples and verify if the results are the ones expected. Microbix is a supplier of these positive and negative controls to lab accreditation agencies, diagnostic test OEMs, and clinical laboratories.

The growth strategy for MBX is to support more test developers and clinical laboratories, and to develop new and innovative QAPs with significant sales potential. The company is also looking to partner with large manufacturers of diagnostic and testing supplies, such as their Strategic Agreement with Copan Italia S.p.A., the global leader in patient-specimen collection devices.

For this business line, the growth trend is impressive. In all of fiscal 2020, MBX sold $1.5M in QAPs. Then in fiscal 2021, they sold between $1M and $1.5M in QAPs per quarter for each of the first three quarters. The next goal is to ramp up to $1M in sales per month before the end of fiscal 2022.

We are seeing growth for several reasons. First, the macro environment is excellent since U.S. and European labs are strongly encouraged to use third party quality controls when available. Second, this is a very large market. For the first category of products, PTD (white label for lab accreditation organizations), the management’s revenue target is $2M/year. For the second category of products, PROCEEDx (branded products sold to diagnostics OEMs), it’s more than $10M/year, with a list price of US$15-US$30/unit, and for the third category, REDx (branded products sold directly to labs), it could be in the $10’s of millions per year with a list price higher than US$30/unit and gross margin of 70%+.

If well-executed, the QAPs strategy has the potential to become a $100M+ business in the longer term. Again, the short-term target is to get to $1M of revenue per month, from $1.5M+ per quarter currently. The gross margins on these products are higher than the antigen business, in the 65% to 70% range, so a strong QAPs growth rate could significantly impact the bottom line.

Viral Transport Medium (VTM)

This newest division is marketed under the brand DxTM. DxTM is a test sample-collection device that is essential for PCR-testing for the virus causing COVID-19. VTM is the vial of liquid into which swabs of patient test samples are placed. VTM preserves any virus’ stability until the clinical lab can test it.

MBX approached the Government of Ontario about the need for a local VTM supplier to fulfill the province’s needs because they had trouble obtaining reliable supplies. The Ontario Together Fund granted MBX with $1.45M to fund the build out of MBX’s VTM production capacity. After MBX put the manufacturing capability in place, they received a first order of $4.25M from Ontario. This initial order for DxTM was delivered across Microbix’s fiscal Q3 (40%) and Q4 (60%), so from May to September. The production capacity is currently at 50k vials per week, and the target in the long run is to ramp up to 60k vials per day. The selling price is in the range of $4 to $6 per vial, with a gross margin starting at around 50% that could increase to 60% with economies of scale.

The potential of this business is already demonstrated since MBX received an initial order from Ontario, with potential for more orders after this one is fulfilled. What is interesting with this contract is that going forward, Microbix is now included on Ontario’s short-list of preferred vendors and, at present, is the only listed domestic manufacturer of VTM. Microbix believes the government of Ontario is looking to have 1 or 2 local suppliers of VTM and 1 or 2 additional international suppliers.

Microbix is positioned to be the baseload supplier for the province and should not be significantly impacted as marginal demand decreases as a result of decreased COVID testing in the future. Microbix should supply between 25% and 50% of the Ontario demand in the near term. The Company has initiated discussions with other Canadian provinces, but the initial goal is to fulfill Ontario’s needs before supplying others.

In the longer term, the Company anticipates that this VTM division can remain strong even after the wave of COVID testing, because the need for other disease testing will ramp back up. In the past, governments didn’t want to invest in the infrastructure for massive testing centers, but COVID forced their hand and now the infrastructure is in place. With this infrastructure in place, the demand for other disease testing should increase dramatically post-COVID, creating excellent growth potential for MBX.

Free Call Option: Kinlytic®

Microbix owns the rights to a biologic drug asset called Kinlytic Urokinase, a human protein that dissolves blood clots and has been used to treat multiple clot-related disorders in millions of patients. The product was taken off the market many years ago because it was very complicated to manufacture. Given its manufacturing expertise, MBX bought the rights and sought a partner to bring the product back to market. Unfortunately, nothing happened because it required a significant CAPEX to restart the project, which the company didn’t have.

Microbix is looking for a commercial partner that could invest the required CAPEX and commercialize the product for a key sub-indication, while MBX would provide its expertise and be entitled to a share of the profits. Microbix has been looking for a strategic partner for a very long time, so the market has very low expectations for this intangible asset. Even if the market is currently not putting any value on it, MBX management mentioned during a recent update call that they are optimistic about announcing a partner by the end of calendar 2021.

This is excellent news for the Company since the opportunity is enormous. The forecasted sales for the product are estimated at $250M per year, and MBX is looking to keep 33% or more of the economics, so potentially $82.5M+ of revenue.

However, it would take up to 40 months to be back on the market after the announcement of a definitive agreement. But again, it’s a free call option!

Share Structure

Financial Performance and Valuation

We are already nine months into fiscal 2021 (October 2020 to September 2021), so the 2021 forecast should be fairly accurate and not materially new to investors.

For fiscal 2022 (September 2021 to September 2022), I modeled the Antigens revenue halfway through it’s pre-covid level, the goal is the return to $12M in fiscal year 2023. For the QAPs division, even though management’s target revenue is $1M/month, I decided to go more conservatively with $9M for the year. They are already at $500K/month so I assumed they could ramp up to $750K/month. For VTM, I modeled 40k vials per week for 52 weeks at $4 per vial. The gross margin estimate is slightly higher than the previous year.

I modeled fiscal year 2023 as the year they achieve all of their goals, with $12M in revenue for each division.

Based on my assumptions, an EBITDA margin of 35% is easily achievable with the strong growth in QAPs and VTM.

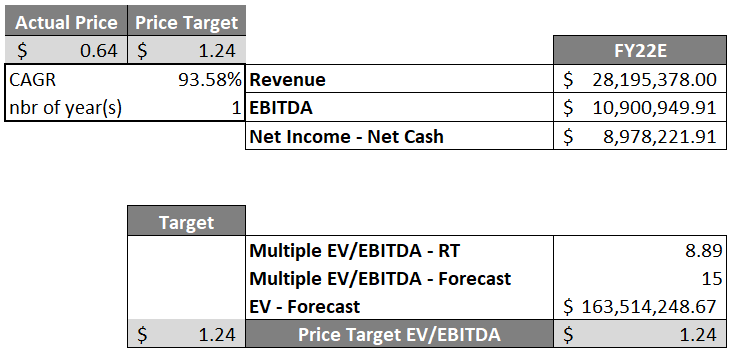

To reach a price target, I used a 15x EV/EBITDA multiple on 2022 numbers vs a multiple of 8.89x currently at $0.64/share, which gave me a target of $1.24, or a 93.58% potential return.

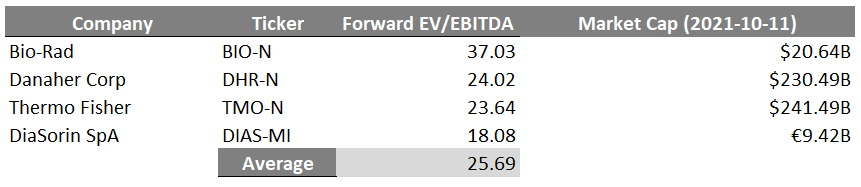

The 15x EV/EBITDA came from an analysis of comps (see table above). Even though peers trade at 25.69x forward EBITDA, I used 15x to include a size and liquidity discount.

MBX is a long-term hold, and I’m showing the multiples and a price target only to demonstrate how cheap the stock currently is, and the potential of 90%+ return in the coming year.

Potential Catalysts

- New contracts for QAPs with distributors in countries where the company is not yet operating.

- Contracts with diagnostic OEMs for Microbix to supply QAPs for inclusion with their testing cartridges/consumables.

- Follow-on orders from Ontario after successfully fulfilling the first VTM order.

- New VTM orders from other provinces.

- Announcement of a partnership for Kinlytic.

- A significant quantity of warrants ($0.36 and $0.55 strike prices) is expiring this month. This is creating an overhang on the stock that should be gone by the end of October.

Risks

In all companies, there are some risks that we should keep an eye on. Here is some that are worth mentioning:

- High client concentration: For the quarter ended June 30, 2021, five customers accounted for 69% of revenues.

- Growth in the VTM business could slow down when the massive wave of COVID testing begins to ebb.

- Manufacturing issues and problems delivering their orders: this could be reflected by a fluctuation of the gross margin in one of the divisions. The company also needs to invest to ramp up its manufacturing facility for QAPs and VTM, which comes with execution risks.

- High dilution risk: there are many options, warrants and other convertibles outstanding, which could affect shorter-term trading patterns. The share structure is definitely not ideal.

Final Thoughts

Microbix has a long-standing operational history of slow growth in the antigen market. With a CEO now focused on growing the QAPs and VTM segments, I am confident that this stock is headed towards a great future, with the possibility of a 90%+ appreciation within the next year.

About the Author

Philippe Lapointe is passionate about fundamental analysis. After working as a commodity trader in the energy sector for a few years, he decided to refocus his career on equity research. In 2021, he joined Rivemont as an analyst for the Rivemont MicroCap Fund, where he works closely with Mathieu Martin. Philippe holds a Bachelor of Commerce degree from McGill University. He is also currently pursuing the CFA (Chartered Financial Analyst) designation.

Disclosure

Philippe Lapointe, the author of this article, is employed by Rivemont Investments (“Rivemont”) as an analyst for the Rivemont MicroCap Fund (the “Fund”).

Mathieu Martin, the president and sole owner of Espace MicroCaps, is also employed by Rivemont Investments as an analyst for the Rivemont MicroCap Fund.

Both Philippe Lapointe and Mathieu Martin are involved in the decision-making and recommendation process regarding whether the Fund should buy or sell individual securities. Both are also a unitholders of the Fund.

As of October 12th, 2021, the Rivemont MicroCap Fund holds a position in Microbix Biosystems (MBX.TO). This position is subject to change without any notice, at the Rivemont MicroCap Fund portfolio managers’ sole discretion.

Mathieu Martin also holds Microbix Biosystems (MBX.TO) securities personally.

This article is neither an offer to sell nor a solicitation of an offer to purchase securities and should not be considered legal, tax, financial, or investment advice. Several estimates and assumptions have been used in the writing of this article. Espace MicroCaps does not guarantee the validity of the information presented.

Espace MicroCaps is not responsible for direct or indirect trading losses caused by the information presented on this blog. Everyone is advised to make their own analyses and inquiries and consult their own professional advisers regarding legal, tax, accounting, and other matters relating to the acquisition, holding, or disposition of an investment.

What is your current updated view on Microbix Biosystems (MBX)

Any comments you’d like to make are appreciated.

Is it still a top pick of the fund?

Thank you,

Our view hasn’t changed much, and we remain bullish on MBX. It is still a top pick for the fund. We named it our #1 top pick for 2022 in this video: https://www.youtube.com/watch?v=kQkhGD9HMn8&t=1s&ab_channel=Rivemont

All the best,

Mathieu Martin

Looks like your FY 2022 financial estimate are going to be way, way off

Revenue growth will accelerate in Q3 and Q4. But yes, I agree, we could be a few million off on this estimate. The long-term investment thesis remains intact.

July 9, 2022

Mr. Philippe Lapointe,

Microbix has been for an excessive number of years flagged as a promising company, but has never been able to create interesting shareholders’ value. I personally became a shareholder in 1993, buying and selling shares at different cycles (highs and lows). It doesn’t appear that any major shareholder is pressing management/board of directors to simply put itself on sale or achieve a merger with a much larger company in order to prosper. Microbix will never achieve on its own the target prices that are promoted by financial analysts. The company has probably been shopped around (receiving informal offers to be purchased), that is a big question that minority shareholders should be aware of. There is just no competitor that will ever pay $1.00 or more to acquire Microbix, therefore it is a waste of time to hire media relations private companies to lure shareholders on rewarding prospects for the company. Microbix’s CEO Cameron Groome should demonstrate consciousness and have the company be putted for sale.