Brandon Mackie |

Case Study: Pioneering Technology Corp. (PTE.V)

Founded by Paul Andreola and Brandon Mackie, Smallcap Discoveries is a paid newsletter dedicated to the discovery of the most promising emerging companies in Canada. Their methodology has enabled them to identify and invest profitably in some of the best performing stocks in the Canadian market during the last couple years. Their style is simple but effective — invest early on in discovery at unreasonably low prices and sell to institutions much later in the process for several times their cost base.

Becoming a member brings many interesting benefits, including privileged access to Paul and Brandon on their forum and exceptional private placement opportunities. Become a member today by clicking here: Smallcap Discoveries.

Smallcap Discoveries launched in November 2014 with one mission: to discover Canada’s best emerging growth companies. In our first year, we found two big winners in Hamilton Thorne (TSX Venture: HTL) and Lite Access Technologies (TSX Venture: LTE). And one loser in Intema Solution (TSX Venture: ITM).

But fast forward to March 2016. It had been almost a year since our last investable idea — Lite Access. Our patience was growing thin.

It was then we began looking at a tiny company out of Ontario, Canada, Pioneering Technology Corp. (TSX Venture: PTE). Pioneering was no stranger to us. We’d owned the stock in the past. But they couldn’t deliver the consistent results we needed to see.

We heard they were doing a private placement and decided to take another look. This time we said was different. Those are dangerous words in investing.

PTE had grown revenues three quarters in a row. Product demand was there. And if they could raise a few million bucks, management claimed they would deliver on some even bigger orders.

We decided to take a significant position through the private placement at $0.125. Fast forward to today, PTE trades at $1.15, up 820% in 11 months. It’s been a wild ride as you can see from the chart:

What we saw in PTE — and how it became one of our biggest winners of all time — is the subject of today’s guest post.

The Business

What do these guys do? They make stove-top burners that prevent cooking fires. That’s it. It’s as simple of a business as you’ll find. Here’s a picture of it:

PTE had a simple solution to a BIG problem. Each year, the U.S. endures 570 deaths, 5,430 injuries, and $1.1 billion in property damage. All because of a preventable problem: cooking fires.

You see if you are going to get a 10-bagger, you are going to need large institutional buyers to sell to on the way up. Retail guys aren’t enough to get a stock up 10X in under a year.

And for institutional buyers to get their other friends to buy, they need to be able to tell the story. A simple, yet sexy, story is key.

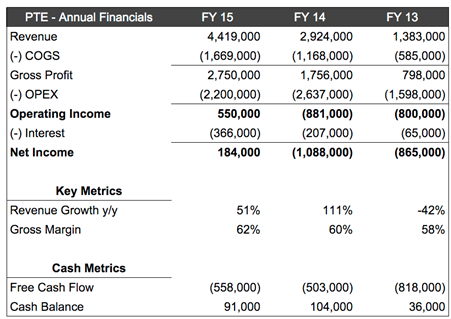

Now a story is a good start — but it’s not enough to make an investable idea. The numbers have to be there too. Here’s what we saw in our analysis from March:

If we could only know two things, it would be revenue growth and gross margin. A gross margin over 50% tells you the company has pricing power. Perhaps they have a strong brand or little competition.

For PTE we found it was both — they virtually created this market and were the only game in town. Their products had been installed on over 140,000 stovetops without a single fire. No new entrant could say that.

Revenue growth tells you something is working in the market place. As an investor, you aren’t going to get to talk to their customers. You’ll never understand the industry as well as management. But revenue growth tells you 90% of what you need to know. You’d be amazed how often investors over think this simple point.

We use simple criteria at Smallcap Discoveries: 25%+ revenue growth year-over-year, gross margins over 50%, and profitable operations. Pioneering passed all three with flying colors.

So we had a simple company and simple story. It was growing, profitable, and had strong margins. The business checked all the boxes. Next it was time to investigate PTE the stock.

Capital Markets

You can do all the due diligence in the world but insiders will always know more than you. That’s why it’s vital to ensure management’s interests are aligned with your own.

We want to see management own multiples of their salary in stock. And we especially like to see insiders buy stock with their own money.

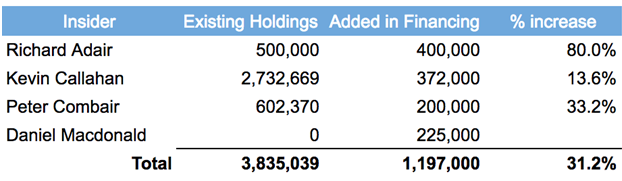

We pulled up the Management Information Circular for PTE. CEO Kevin Callahan owned 8.5% of the company. Insiders owned 33.1% as a whole, including one director who owned 20.9%. This looked ideal to us — strong ownership but not too much that shareholders could get taken advantage of.

PTE was doing a major financing at the time. Management was out telling investors if they could raise money, massive growth opportunities lie ahead. If this was true, management should have their check books out alongside investors. And that’s exactly what happened.

We expected significant insider participation. After the financing closed, we checked Sedi website for details (you can also use Canadianinsider.com to get this information) and put together this analysis:

Insiders ended up taking close to 10% of the total financing. They invested $150,000 of their own money. They increased their holdings 31% on average. These were all very bullish signs.

Valuation

The final — and often most important — piece to the puzzle is valuation. We’re big believers you make your money on the way in. Pay bargain prices for a solid company today — and hope it becomes the overpriced darling of tomorrow.

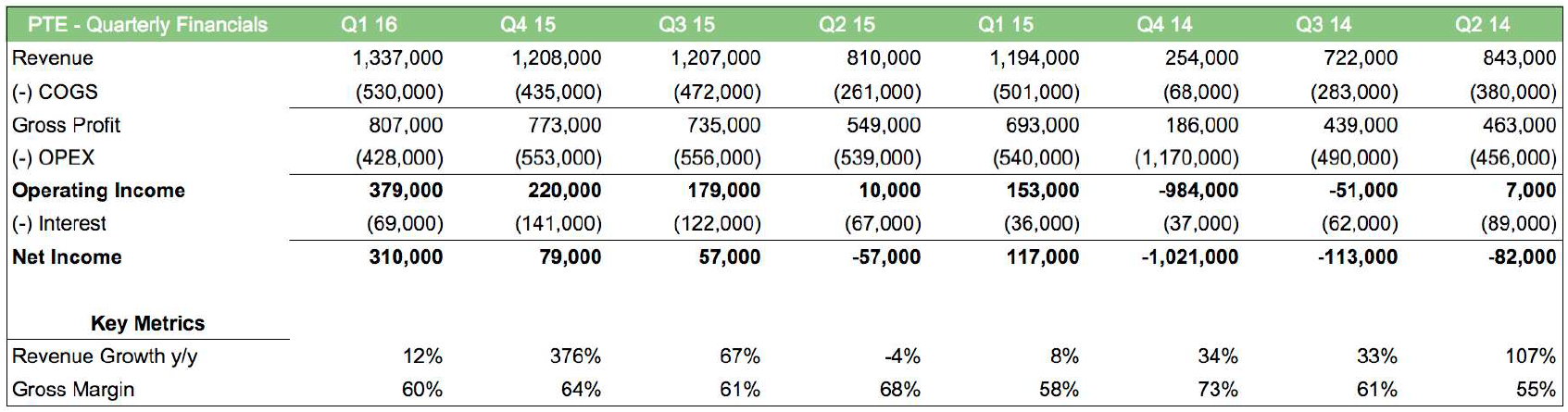

PTE traded for 15X trailing earnings at the time. This was a reasonable, if not cheap valuation, for a company with their growth metrics. But the more we dug in, the more this company looked like a steal. Here’s what we saw in the quarterly financials from SEDAR:

The numbers were telling us PTE’s business was accelerating. Revenues seemed to have stabilized north of $1.2 million. And so, we thought a valuation based on annualized Q1 results made more sense.

Notice the interest expense in table above. Over 25% of PTE’s operating income was going out the door to debt holders. Surely, we thought, a high-growth company that was now profitable could use equity to take out that toxic debt. Management agreed. They cited debt as a top reason for raising money in their Q1 MD&A:

“Pioneering has historically funded its working capital requirements through a combination of cash flow generated by operations and debt and equity financing. The cost of debt financing as Pioneering has been growing has been expensive.”

PTE disclosed in their statements a $250,000 facility guaranteed by their largest shareholder — and they were paying 25% compounded monthly for the guarantee. They also had a $400,000 short-term loan payable to the same shareholder with interest at 25% per year. That was some expensive debt!

We estimated PTE would save $40,000 per quarter in interest alone. And when we combined these savings with our annualized valuation, we saw PTE trading at 4X earnings. It now looked dirt cheap, but you had to dig to see it.

The investment seemed like the classic “heads we win, tails we don’t lose much.” Management could come nowhere near hitting their 50% revenue growth target and at worst we’d likely break even.

PTE checked all the boxes. And so in March we made a significant investment into the company. But the exciting part was only just beginning.

It’s been said the hardest part of multibaggers isn’t finding them — it’s holding on to them. It can be a rocky ride to the top. Here’s how things unfolded over the past year:

- May 30th, 2016: PTE reports Q2 revenues of $1.25 million, up 55% y/y.

- August 17th, 2016: Middle Oak, a multifamily residential insurer, announces a 7% premium discount for all customers who install PTE’s Smart Burners on their properties (When your product pays for itself with insurance savings alone, that bodes well for future sales).

- August 30th, 2016: PTE announces Q3 results. Revenues hit $1.6 million (+35% y/y). Net income at $240,000 (+55% y/y).

- September 6th, 2016: PTE announces the largest order in company history to a leading North American Hotel Chain. The order is for 8,800 units, or ~$1.6 million, and covers 20% of the hotel’s portfolio. The market begins to speculate about PTE capturing the other 80% of their properties.

- October 19th, 2016: PTE pre-announces Q4 results — revenues up 120% to $2.6M. FY 2016 revenues of $6.8 million (+55% y/y) and net income of $1.06 million (+649% y/y)

- January 10th, 2017: PTE receives follow-on order from Leading North American Hotel Chain. Order is for 10,140 units, $1.8 million. This order marks a new record for the company.

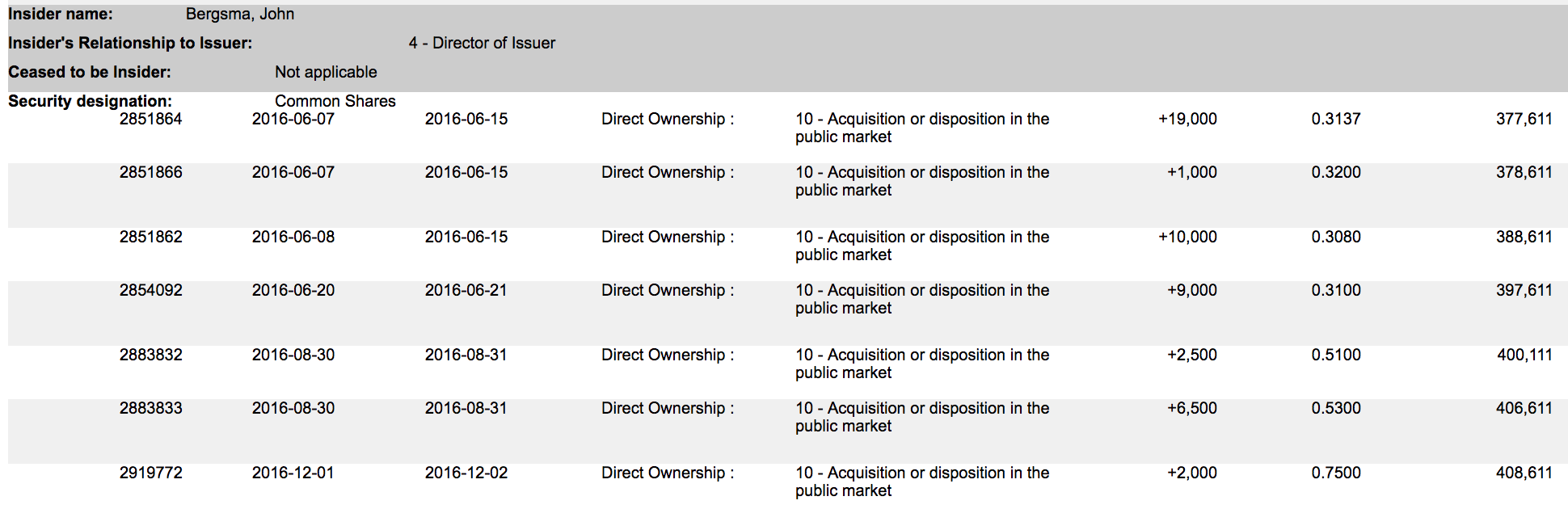

And what were insiders doing over this time? At least one of them was buying hand over fist:

Peter Lynch likes to say insiders sell for all sorts of reasons — but they only buy for one. And when those purchases are made at multiples of your buy price, that’s a great sign.

Deep value combined with business momentum is the fastest path we know of to multibagger success. As the stock approached $1.00, PTE’s market cap crossed $50 million. That’s an important threshold as it’s no longer a “penny stock.” Many institutions can now own it.

You see many growth funds are measured relative to their peers. And if one of your competitors owns a hot growth stock, you’ve got to own it — or risk falling behind. This competitive game can make for big gains on high volume. That’s what we’ve likely seen recently with PTE.

We’ve trimmed our position into recent strength but still hold almost every share we bought in the private placement. Management is guiding for another year of 50% revenue growth. Regulation is due out this year that requires ALL electric coil cooking appliances to include fire prevention technology in 2019.

This one will be a fun one to watch in 2017.

We have invested in a number of companies that have similar characteristics as Pioneering Technology Corp. did at early stages. We invite you to discover these companies — and our process behind finding them — at www.smallcapdiscoveries.com

Disclosure: Paul Andreola, Brandon Mackie, Mathieu Martin and Philippe Bergeron-Belanger are long shares of PTE.V.

Amazing article ! Thank you

With a risk profile this good, is there any reason why you wouldn’t want to invest 90% of your portfolio in this one company?

We never know what can happen. As bullish as I can be on certain stocks, I seldom invest more than 20-25% of my portfolio. You have to manage your portfolio risk in a way that you won’t ever get wiped out by unexpected events. For instance, I’ve been a shareholder of Xpel Technologies Ltd (DAP.U.v) for years now. The 3M lawsuit was a black swan event. NOBODY saw it coming and the damages were substantial.

For what it’s worth, PTE is a 10% position for me.

Hi,

Great article! Very well researched. One thing that bothered me is that, yes, their revenue and Op Income and Net Income are all going up very strongly, but they don’t generate any Free Cash Flow, and the number of shares has doubled in the last five years. I know for a small company, they need to sell shares to raise capital, but 100% increase in shares is some serious dilution.

It is now july 2018, a whole year an a half after this publication. Can someone explain why pte is now trading at 27¢. ?!?!? I bought some at 89¢ in December of 2017, but ended up losing half a my money 🙁

Unfortunately the company didn’t show a whole lot of progress since last year. It seems like the sales cycles are longer than expected, which leads to lumpy financial results. We still think the company has a bright long-term future, but it will require some patience. – Mathieu

Excellent article. I took a current look at company and they’re share price has fallen since the last comment. The company states that this has to do with moving from direct to distributor-based sales. Cash position seems strong, and they haven’t taken to discounting. Warily smelling a bargain, but would love to hear your thoughts.

Hi Keith, thanks for your comment and sorry for the long time to reply! PTE is very difficult to value right now because, as you mentioned, the company has moved from direct sales to a distribution model. The company saw early success with the new model but has failed to show any kind of meaningful progress in the last few quarters. If this ends up just being a result of longer sales cycles, the strong cash position will allow them to make it through. However, if the distribution model just doesn’t work, it could get ugly as the company will burn through its cash reserves. For someone who believes in the business model, I would say the risk/reward potential appears very attractive right now. – Mathieu