Mathieu Martin |

Rivemont MicroCap Fund Quarterly Letter – Q4 2018

Rivemont Investments, a portfolio management firm for which we are external consultants, recently released its Rivemont MicroCap Fund quarterly letter for the fourth quarter of 2018. Martin Lalonde and Jean Lamontagne, the fund’s portfolio managers, have given us the permission to republish on Espace MicroCaps an abridged version of the letter sent to clients. For more information about the Rivemont MicroCap Fund, please visit www.rivemont.ca/en/rivemont-microcap-fund.

If you followed the economic headlines or looked at the value of your portfolio during the holiday season, you may have noticed that a significant correction took place in the North American stock market during the fourth quarter of 2018.

Corrections like this are unfortunately part of the process of investing in equities. Markets are and will always remain cyclical; the most important thing is to be well prepared when a decline occurs and then to position the portfolio to take advantage of the eventual rebound when the market conditions improve. For the Rivemont MicroCap Fund this was the first test, during a market decline, of the resilience of the stocks we selected.

Here are some metrics about the fund as at December 31st, 2018:

- $4.07 million in assets under management.

- 97.7 % was invested in stocks and 2.3 % remained in cash or dividends receivable.

- 24 positions, the largest representing 9 % of the portfolio.

- Return of -9.1 %* for 2018.

* Net return after all fees. Please note that individual performance varies based on the price paid per unit.

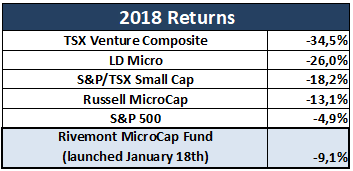

For the full year 2018, the table below provides an overview of the total returns (including dividends) of a few North American indices:

Although the fund’s performance has been negative for 2018, you can see in the table above that the environment we had to navigate in this first year was quite difficult. Large caps outperformed micro and small caps in 2018, as demonstrated by the performance of the S&P 500 relative to the other indices in the table. That being said, we are pleased to report better results than the major micro and small cap indices in both Canada and the United States. We were already ahead of the indices earlier this year and did not underperform during the fourth quarter correction, which is an acceptable outcome in those circumstances.

Why Are Microcaps More Affected Than Large Caps During Tough Times?

When markets fall sharply, institutional investors such as banks, large investment funds, and stockbrokers generally contribute to a larger decline in microcaps, compared to large caps, for two main reasons:

- They need cash to accommodate the increasing withdrawal requests from their worried clients.

- They seek to reduce the level of risk in their portfolios and therefore get rid of the riskiest assets: microcap stocks.

Since we generally invest in smaller, more illiquid companies than those included in indices, we believe our holdings will be less affected, in general, because few institutional investors own them. For this reason, we believe we are in a great position to act defensively during bear markets while we continue to buy and hold high-quality companies. During market declines, it is a great opportunity for us to increase the overall quality of the portfolio in order to take advantage of the next bull market.

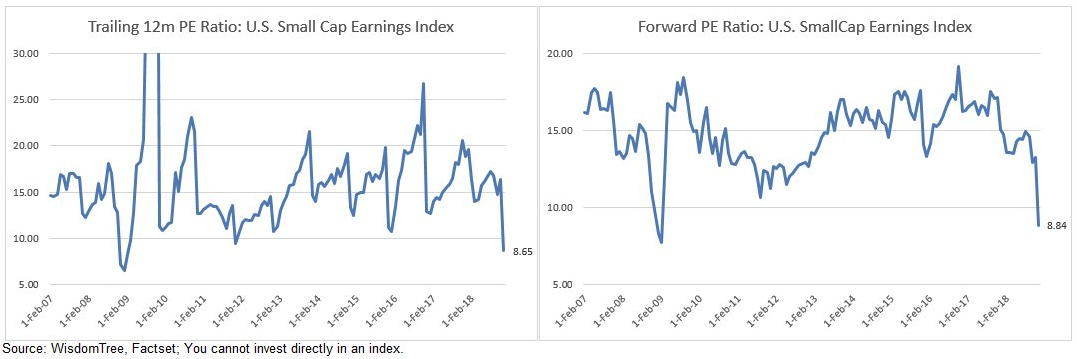

The following charts provide a good illustration of where we currently are in terms of valuations in the small cap universe. The charts present the price-earnings ratio (P/E) for the last twelve months and the next twelve months (forecasted) for the WisdomTree U.S. Small Cap Earnings Index:

There are two important points to highlight from these charts. First, in absolute terms, it seems that the small cap market represents an attractive bargain today with a price-earnings ratio under 9 times. Secondly, in relative terms, we can observe that the index has rarely been at such a low level in the last twelve years, and every time that has happened, there has been a sharp rise the year after.

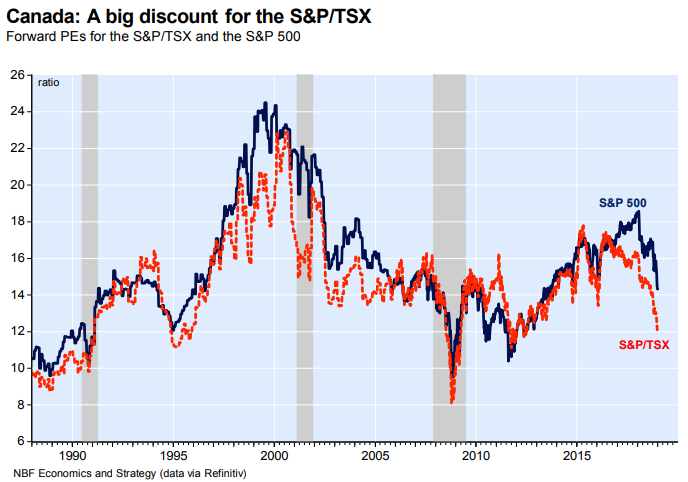

As for the Canadian market, National Bank published in a monthly report on January 7th that the Toronto Stock Exchange’s S&P/TSX index reached its lowest price-earnings ratio in six years, at about 12 times the forecasted profits for next twelve months. Also, there has never been a larger difference between the valuations of the Canadian and US markets since 2002 according to a chart published in the report:

The above statistics suggest that the microcap and small cap markets, as well as the overall Canadian market are currently out of favor. To us, that is usually a good time to hunt for bargains.

Three Principles to Navigate in a Volatile Market

Toward the end of 2018, many of the quality stocks we own experienced significant declines as a result of the general market correction, which affected the fund’s overall performance. We are still very confident and optimistic about the long-term prospects of the stocks that have suffered losses and have taken advantage of the recent downturn to buy more of the quality businesses we already own.

Our strategy in a bear market is based on three fundamental pillars:

- Focus on quality businesses.

- Cut the weeds and avoid speculative stocks.

- Maintain a sufficient level of cash to take advantage of good opportunities.

We think we have done very well on points 1 and 2. With regard to point 3, the cash position, it was 2.3 % at the end of 2018 which is well below our target of 10 % to 15 %. The main reason is, again, because we took advantage of the recent decline to deploy more capital into the best stocks we own, as well as a few new ideas. Since the beginning of 2019, there have been some opportunities to sell stocks at attractive prices to bring the cash position back to a more comfortable level. We are therefore on our way to return to our cash target over the next few weeks.

2019 Outlook

Although the market has been volatile recently, our investment strategy remains similar regardless of market conditions. We want to own profitable companies that are growing, with solid balance sheets and that can take advantage of tough times to get ahead of their struggling competitors … or even buy them at a discount. This strategy saves us from having to guess in which direction the market will be headed next since it should work well in any market conditions.

Speaking of our focus on quality companies, the strategy yielded excellent results so far in 2019. Markets have experienced strong rebounds after Christmas and so did the Rivemont MicroCap Fund. As of January 17th, Series B units (MAJ724) were already back up 5.0 % in just over two weeks.

To conclude this 2019 outlook section, we want to leave you with an example that illustrates how difficult it is to make predictions about the direction of the markets. This quote was taken from the book Mastering the Market Cycle by Howard Marks:

”For how many of the 47 years from 1970 through 2016 was the annual return on the S&P 500 within 2% of “normal”—that is, between 8% and 12%?

I expected the answer to be “not that often,” but I was surprised to learn that it had happened only three times! It also surprised me to learn that the return had been more than 20 percentage points away from “normal”—either up more than 30% or down more than 10%—more than one-quarter of the time: 13 out of the last 47 years. So one thing that can be said with total conviction about stock market performance is that the average certainly isn’t the norm.”

Our takeaway: it is much better to focus on the long term and not worry too much about the results in a single year.

We wish you all a prosperous 2019!

Rivemont Investments

Portfolio Manager of the Rivemont MicroCap Fund

To take a look at the Fund’s fact sheet and presentation, or for any other information requests, please visit: www.rivemont.ca/en/rivemont-microcap-fund

Disclaimer

Espace MicroCaps is under contract with Rivemont Investments (“Rivemont”) to provide securities and strategy analysis for the Rivemont MicroCap Fund (the “Fund”). In other words, Espace MicroCaps acts as external expert/consultant for the Fund. In return for this expertise, Espace MicroCaps is remunerated by Rivemont.

Decisions as to whether or not to trade a security for the Fund are made exclusively by Rivemont.

This article is neither an offer to sell nor a solicitation of an offer to purchase securities or units of the Fund and should not be considered legal, tax, financial or investment advice. Espace MicroCaps does not guarantee the validity of the information presented.

Espace MicroCaps is not responsible for direct or indirect trading losses caused by the information presented on this blog. Everyone is advised to make their own analyzes and inquiries and to consult their own professional advisers with respect to legal, tax, accounting and other matters relating to the acquisition, holding or disposition of an investment.