Mathieu Martin |

Rivemont MicroCap Fund Quarterly Letter – Q4 2019

Rivemont Investments, a portfolio management firm for which we are external consultants, recently released its Rivemont MicroCap Fund quarterly letter for the fourth quarter of 2019.

Rivemont is the portfolio manager responsible for the investment decisions of the Rivemont MicroCap Fund.

Martin Lalonde and Jean Lamontagne, the fund’s portfolio managers, have given us permission to republish on Espace MicroCaps the letter sent to clients. For more information about the Rivemont MicroCap Fund, please visit:

www.rivemont.ca/en/rivemont-microcap-fund.

Dear investors,

2019 was an eventful year for the Rivemont MicroCap Fund with a strong start in the first quarter, which placed us among the best performing funds in Canada. In the second and third quarters, the financial markets were calmer and the fund experienced slight declines, only to return in force at the end of the year. We are thrilled to share with you this last update of 2019 with the results for the fourth quarter and the full year. Let’s get started without further ado.

Here are some metrics about the fund as at December 31st, 2019:

- $6.27 million in assets under management.

- 95.5 % was invested and 4.5 % remained in net cash.

- 25 positions. The largest represented 18.6 % of the portfolio.

- The top 5 positions represented 45.9 % of the portfolio.

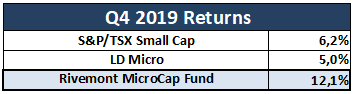

- Fund unit value of $6.23*, for an overall return of 12.1 %** during the fourth quarter.

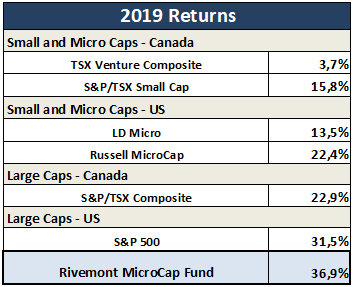

- Return of 36.9 %** for 2019.

* Series B units (MAJ724)

** Net return after all fees. Please note that individual performance varies based on the price paid per unit.

To compare our performance during the fourth quarter (October 1st to December 31st, 2019), we use the S&P/TSX Small Cap Index as our benchmark. This index reflects the small cap market performance in Canada. To get an overview of the US market performance, we refer to the LD Micro Index. Here is the performance of the two indices during the quarter:

The fourth quarter was excellent, and the fund outperformed both indices. As we have repeated many times in the past, it is satisfying to beat the indices over short periods of three months, but we still prefer to focus on long-term performance.

On January 18, 2020, the fund will celebrate its second full year of existence. In almost 24 months, the fund has built a significant lead of 14.9 % on an annualized basis relative to the S&P/TSX Small Cap Index. Essentially, this means that the active management of the fund produced 14.9 % more returns per year than the Canadian small cap market as a whole. This difference is very significant!

For the full year 2019, here is a summary of the total return (including dividends) for various North American indices:

The first category in the table above, small and micro caps in Canada, is the one we are most interested in because it compares directly with our investment strategy. That said, we still like to look at the market as a whole, both in the U.S. and in large caps, to see how our asset class performed relative to other asset classes.

As the table shows, the performance of the Rivemont MicroCap Fund in 2019 was unequivocal: outperformance across the board. Our performance, which was significantly better than that of the Canadian market for the second consecutive year, demonstrates that we can create value with our active stock selection in microcaps.

It is also difficult to overlook the robust performance of U.S. large caps, as evidenced by the exceptional 31.5 % return on the S&P 500. This is a topic we have often heard about this year. Why take the risk of investing in microcaps when large caps, those predictable and stable companies, provide such high returns?

The answer, in our opinion, should not only be based on the returns but also the diversification benefits. Adding a microcap portion to a well-diversified large cap portfolio has been shown mathematically to not only improve the return potential but also to lower the overall risk of the portfolio. Why? Because there is not a perfect correlation between small and large caps. Sometimes one asset class goes up while the other goes down, or vice versa, which balances the returns and reduces the total volatility of the portfolio.

There are many benefits to holding different asset classes in a portfolio, and we think that microcaps are a great addition for investors who hold large caps such as those in the S&P 500.

Valuation Gap Between Small and Large Cap Stocks

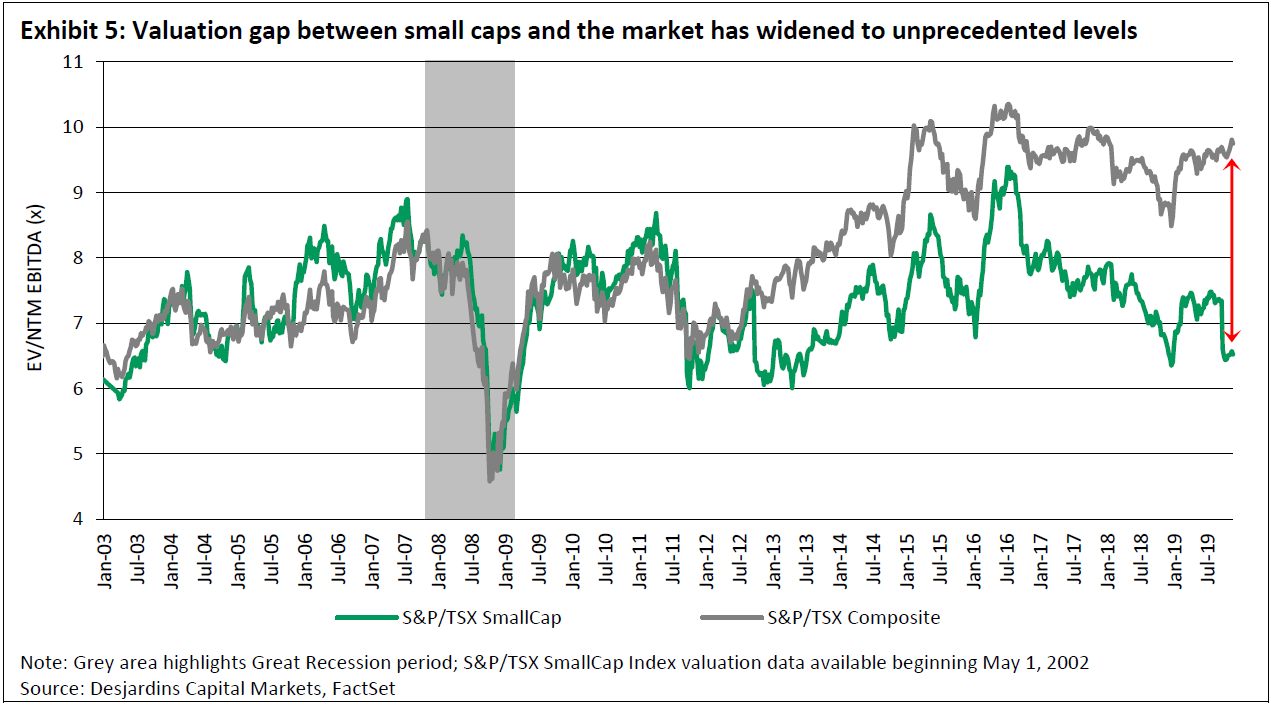

In December 2019, Desjardins Capital Markets published a report about their outlook for the Canadian market in 2020, with a particular focus on small caps.

One of the fascinating takeaways from the report was the chart below, which plots the valuation of small and large caps in Canada (represented by their respective indices) from 2003 to 2019. We can see that, since 2013, the gap between the two indices has widened and has reached an unprecedented level in 2019.

Essentially, what this means is that investors have been favoring large caps over small caps for several years now. According to Desjardins Capital Markets, “the small-cap underperformance may highlight the growing flight to value, quality and safety by investors.” This divergence creates opportunities for good small cap managers to create value by picking stocks since few other professional managers are interested in the sector, and more securities are mispriced.

In the longer term, we think there is a good chance that this trend will reverse. Markets are cyclical, and divergences like we observe today are likely to revert to their historical mean eventually. If this were the case, we could see a small cap outperformance for a few years, which would be favorable for the Rivemont MicroCap Fund.

It is especially interesting to note that despite the excellent performance of the Rivemont MicroCap Fund in 2019, the Canadian small cap asset class was facing a marked decline in popularity. Despite all the talking in the media about the longest bull market in history and the high valuations across the board, Canadian small caps are still trading below their average valuation of the last sixteen years and “have become increasingly attractive,” according to Desjardins Capital Markets.

Outlook

While many financial pundits are concerned about the current economic environment, we think the context for microcaps in Canada is exceptional. Our contrarian approach to investing often takes us to places that are unpopular… until there is a trend reversal. And Canadian microcaps are not popular right now.

We still find a lot of bargains in the current market, contrary to what can be seen in large caps, especially in the United States. In our view, the Canadian market could experience renewed popularity and could be a fantastic place to be over the next few years.

We also want to make a quick mention of the cash position in the fund. You may have noticed that once again, the fund’s cash position at December 31, 2019, was lower than our target (4.5% versus a target of 10%). We think that the majority of our portfolio holdings are trading at very attractive valuations, which makes it difficult to sell and raise additional cash. You can interpret the low level of cash as a high level of conviction in the companies we currently own, which bodes well for the future.

In closing, we would like to remind you that the Rivemont MicroCap Fund is still growing and looking for new capital. We welcome references for long-term investors who are interested in our strategy. Also, please note that since January 1st, you can contribute an additional $6 000 to your TFSA for 2020. As for the RRSP, you have until March 2nd, 2020, to contribute for the 2019 taxation year.

If you wish to increase your participation in the fund, do not hesitate to contact us and we will be happy to discuss it with you.

Thank you once again for the trust you have placed in us. We wish you a healthy and prosperous 2020!

Rivemont Investments

Portfolio Manager of the Rivemont MicroCap Fund

Disclaimer

Espace MicroCaps is under contract with Rivemont Investments (“Rivemont”) to provide securities and strategy analysis for the Rivemont MicroCap Fund (the “Fund”). In other words, Espace MicroCaps acts as external expert/consultant for the Fund. In return for this expertise, Espace MicroCaps is remunerated by Rivemont.

Decisions as to whether or not to trade a security for the Fund are made exclusively by Rivemont.

This article is neither an offer to sell nor a solicitation of an offer to purchase securities or units of the Fund and should not be considered legal, tax, financial or investment advice. Espace MicroCaps does not guarantee the validity of the information presented.

Espace MicroCaps is not responsible for direct or indirect trading losses caused by the information presented on this blog. Everyone is advised to make their own analyzes and inquiries and to consult their own professional advisers with respect to legal, tax, accounting and other matters relating to the acquisition, holding or disposition of an investment.