Mathieu Martin |

Espace MicroCaps Top Picks: MediaValet (MVP.V)

All figures are in CAD unless otherwise noted.

Share price: $1.42

Shares outstanding / fully diluted: 24.4M / 36.9M

Market Cap: $34.6M

Debt: $3.5M

Cash: $2.6M

Fully diluted Enterprise Value: $42.7M

Will this stock be your portfolio’s MVP in 2020?

Investment Highlights

- Software-as-a-Service (SaaS) company with 90% of recurring revenues and gross margins of over 85%

- 100%+ net customer retention rate in 2019

- Revenue CAGR of 56% for the last three completed fiscal years (2016-2018), with an acceleration of the growth rate expected in 2019

- Close to cash flow positive

- Management team with experience and skin in the game (37% insider ownership)

Company History

Mediavalet and its predecessor company, VRX WorldWide, have a 20-year history as a public company. The journey started in 2000 when public company Cambridge Ventures bought a private company called VRX Studios (later renamed VRX WorldWide) and brought on its founder, David MacLaren, as CEO of the public entity.

VRX was a visual content provider for the travel, tourism and hospitality industries. Essentially, through a network of freelance photographers around the world, VRX was creating virtual tours, interactive maps and photoshoots for e-commerce travel websites to enhance traffic, stickiness, and ultimately bookings. VRX grew from virtually no revenues in 2001 to a high of $6M in revenues in 2009, followed by a few challenging years during which sales settled in the $3-4M range.

The most interesting takeaway from the VRX story is that the company was managing a colossal amount of visual content (40+ terabytes) for over 8000 hotel customers, and management discovered how complicated and painful it was to maintain such a large digital asset base.

In 2010, after a year-long search for an affordable digital asset management solution, the VRX team threw in the towel. There was simply nothing on the market that could meet VRX’s needs. That is when David MacLaren realized he probably wasn’t the only one with this problem, and it led him, and his CTO Jean Lozano, to develop VRX’s own digital asset management solution on the Microsoft Azure cloud. Mediavalet was born. And management soon realized that this was a high-growth product.

In August 2014, MacLaren and the board decided to realign the company’s focus on Mediavalet and sold the legacy photography business for $3M.

Today, Mediavalet is a fast-growing enterprise digital asset management (DAM) platform that supports marketing and creative operations around the world. It is 100% cloud-based and sold on a recurring Software-as-a-Service (SaaS) model. Since 2010, over $24M has been invested in building the product and business.

What is a DAM?

A digital asset management (DAM) platform allows companies to aggregate, organize, manage, secure, and distribute all their digital assets. Think of large companies such as A&W, Hello Fresh, Sunwing, Experian or Colliers International (some of Mediavalet’s customers) and the massive amounts of visual content created by their marketing and communications teams that they have to manage daily across their employee base, customers, partners, vendors and media outlets. We’re talking about hundreds of thousands of files that need to be stored, organized, and retrieved when needed.

Companies use DAM platforms to reduce the cost of digital media by reducing the waste of time and by improving the efficiency of marketing and creative teams. Another advantage is that by centralizing all of a company’s digital assets in one place, sales teams are empowered to find up-to-date and relevant content to drive increased revenues.

The DAM industry has been around for 30+ years but initially catered to large enterprise customers who had their own IT infrastructure and used the software on-premise. Over the last ten years, this has been rapidly changing with the advent of cloud computing, making it more practical for a variety of companies to implement a DAM solution.

The DAM market is currently estimated at US$3 billion and is expected to grow to US$7.5 billion by 2024, according to MarketsAndMarkets. About 80% of sales opportunities today are still greenfield (customers with no DAM solutions).

The most significant players (Adobe being the main one) are still primarily selling on-premise software licenses while a new wave of cloud-based DAM platforms is quickly gaining market share.

Why Mediavalet?

The DAM industry is quite competitive, and most companies tend to specialize in specific segments of the market or industry verticals. The focus can range from SMBs to large enterprise clients, and from single divisions in a company to the global needs of a whole organization. Finally, the choice of an on-premise or cloud solution is an important consideration, and we think that the future of the industry is in the cloud.

Gartner positions Mediavalet as the highest-rated cloud DAM for the mid-enterprise segment of the market. It is rated as best-in-class for security, speed, redundancy, global accessibility and scalability. According to management, Mediavalet directly competes against only a handful of players in the mid-enterprise segment, the main ones being Adobe, Widen and Bynder.

Besides its best-of-breed enterprise focus, one of Mediavalet’s strong differentiated selling points is its CreativeSPACES application, which is built specifically for creative teams to access global cloud assets at local speeds and to sync their work-in-progress and final assets to the cloud seamlessly. Conversely, most of its DAM competitors only deal with finished media assets (not work-in-progress).

Mediavalet will typically win competitive RFP processes when the customer has a Microsoft Azure cloud strategy and a creative team that needs the CreativeSPACES application, which is one of its kind in the industry.

According to management, the switching costs are moderately high, which makes it hard to steal customers away from competitors but also makes revenues very sticky and predictable. Fortunately, the industry is still in the early stages of growth, and as mentioned earlier, most sales opportunities are to customers that don’t have a DAM solution yet.

Revenue Model

Mediavalet sells its software on an annual recurring subscription (SaaS) model. The average customer pays ~$25,000 per year for the subscription, with a one-time set-up fee of ~$5,000 in the first year. The average customer size has been increasing in 2019 to $28,000 per new customer signed up during the year as Mediavalet is more successful with larger enterprise clients.

The most important thing to understand regarding the revenue model is that most customers are billed for a full year up front when they sign up or renew (“Billings”). However, for accounting purposes, these revenues are recognized on a pro-rata basis in the financial statements over four quarters. This creates quite a significant difference between the timing of cash flows (upfront) and the recognition of revenues in the financials (over a full year).

For this reason, revenue is a lagging indicator of growth due to the deferral of billings in the financial statements. We recommend looking at Mediavalet on a Billings basis because it better reflects the reality of the business. Fortunately, the company makes it easier for investors to track this essential metric by disclosing its quarterly net billings, as well as annual recurring revenue every quarter. Net billings are essentially the sum of invoiced sales during the quarter, including new customers and existing customer renewals. We can calculate net billings from the financial statements by subtracting opening deferred revenue from closing deferred revenue and adding the revenue recognized for the period. Net billings should correlate quite well with the amount of cash coming into the business during the period.

Here is an overview of Mediavalet’s various metrics, which are excellent:

- Net customer retention rate of over 100% in 2019 (more expansion within existing customers than churn)

- Customer Acquisition Cost (CAC) payback of ~10 months

- Annual Recurring Revenues (ARR) of $5.81M as of Q3 2019, and an expected range of $6.37M to $6.48M for Q4 2019

- 3-year revenue CAGR of 56% from 2016 to 2018 and expected to exceed that in 2019

- Net billings growth of 102% for the first nine months of 2019

Management

As mentioned earlier, Mediavalet (and previously VRX) has been led by its founder David MacLaren for the last 20 years. David is a creative entrepreneur, and his passion for the industry transpires when you meet him in person.

Our first meeting with the company, however, was with the Executive Chairman and CFO of the company, Rob Chase. Rob has an impressive and relevant background, which you can judge by yourself by reading his bio:

‘’Mr. Chase held the CFO and COO positions for Absolute Software from 2000 to 2014, and was a key member of the leadership team that grew the company from $4 million to nearly $100 million in annual sales over 14 years. In his capacity at Absolute Software, Mr. Chase completed a number of acquisitions and led many functions of the organization including finance, marketing, business development, channel, customer support, legal and HR. Mr. Chase was also a Board member for PNI Digital Media from January 2013 until sale of the company in July 2014, helping the company return to growth, fund its operations, and ultimately maximize shareholder value through a sale to Staples, delivering an increase in share price from $0.20 to $1.70 over his tenure.’’

After retirement from Absolute Software, Rob was looking to get involved in a new project and saw tremendous potential in MediaValet. Since he joined the board of directors in 2015, Rob supported the company with friendly loans for a total of $2.5M. These loans have now been paid back or converted to equity, and he ended up investing $2.4M of his own money in the equity of the company through a few private placements as well as open market transactions. He currently owns 10.6% of the shares on a fully diluted basis.

Rob is an experienced leader and oversees the company’s finance, accounting, strategy and investor relations activities. Combined with David MacLaren’s vision and solid execution so far, we believe Mediavalet has a winning duo at the helm.

In terms of corporate governance, the board of directors was reconstituted in 2019 and three excellent additions were made:

- Thomas Kenny, a B2B sales expert

- Jake Sorofman, a DAM and marketing expert

- Francis Shen, a successful technology start-up CEO who sold his previous company, Aastra Technologies, for $700M. He is now an institutional investor and a significant shareholder in Mediavalet.

Financial Performance and Share Structure

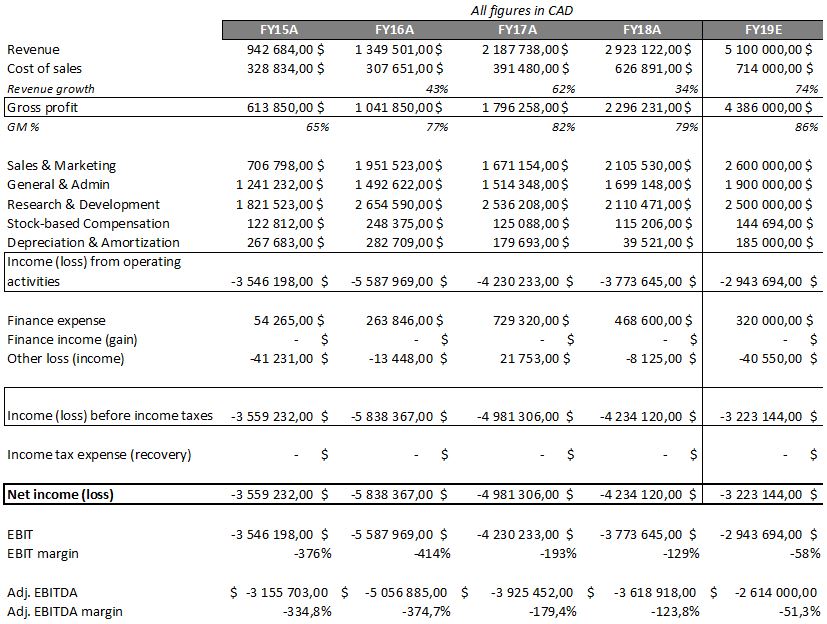

In the table below, you can see the history of financial performance from 2015 to 2018, along with our estimates for 2019 (based on the first nine months of 2019).

The first few things we want to highlight are the strong track record of revenue growth and the high SaaS margins that come with it. As mentioned earlier, the company has a very low historical churn (even negative churn in 2019), which shows how high-quality and predictable those revenues are.

The other main thing that we want to address is the seemingly high burn rate when looking at the financials. Again, remember that revenues (and profits) in the financial statements are lagging indicators of the actual cash flow generation of the business. We recommend looking at net billings instead of revenues because it tracks much more closely how much cash the company is collecting in a given quarter.

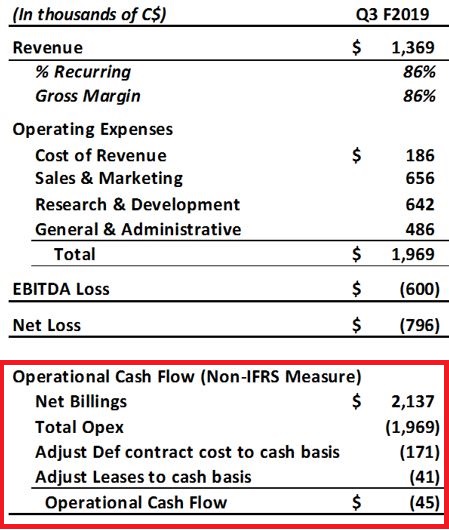

We will borrow part of a slide from the most recent investor presentation where the company provides a comparison of accounting Net Loss versus Operational Cash Flow Loss for the most recent quarter (Q3 2019):

As you can see, from a cash flow perspective, the company was almost breakeven in its most recent quarter. If the company keeps growing its billings (with new customers and existing customer renewals), it will start to generate positive cash flows even though it won’t show in the financials for a few more quarters.

We believe the market doesn’t understand properly this critical aspect of how to analyze Mediavalet, and this is one of the reasons why this opportunity exists.

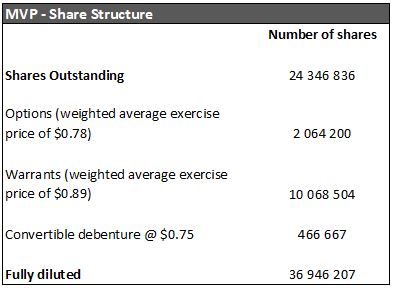

Let’s now take a quick look at the share structure:

Because of the significant burn rate over the last few years, the company had to rely on equity financings to sustain its growth. The share structure was not ideal when we first got interested in this company. Fortunately, things changed recently. The company did a 15 for 1 share consolidation on September 9th, 2019, along with one last substantial equity financing to improve the balance sheet (6.66M units at $0.525).

Most of the warrants have a strike price of $0.90 and were issued as part of the most recent $3.5M financing in September 2019. They were set to expire in September 2022. However, the company announced on Tuesday that it is accelerating the expiry of 7.1M warrants (0.47M at $0.75 and 6.67M at $0.90) to April 27, 2020. We expect shareholders to exercise these warrants, which will provide a significant cash infusion of more than $6M for growth initiatives.

We believe that the shares and warrants from the last financing are in the hands of long-term shareholders, as there were only 16 subscribers in the round, including us (Rivemont MicroCap Fund), the CEO, the Executive Chairman, and a couple of directors (one of which accounted for $1.5M of the round). Also, there has not been selling pressure in the market since these shares became free from trading restrictions last month.

The company currently has $2.97M in working capital (excluding deferred revenues), which we think is enough to get them to sustained positive cash flow generation and also provides the flexibility to keep spending on growth initiatives.

Finally, there is $3M in senior secured debt since 2017. The initial interest rate was 10% and was renegotiated down to 7% in 2018. This debt is repayable anytime without penalty and is due in November 2021.

Valuation

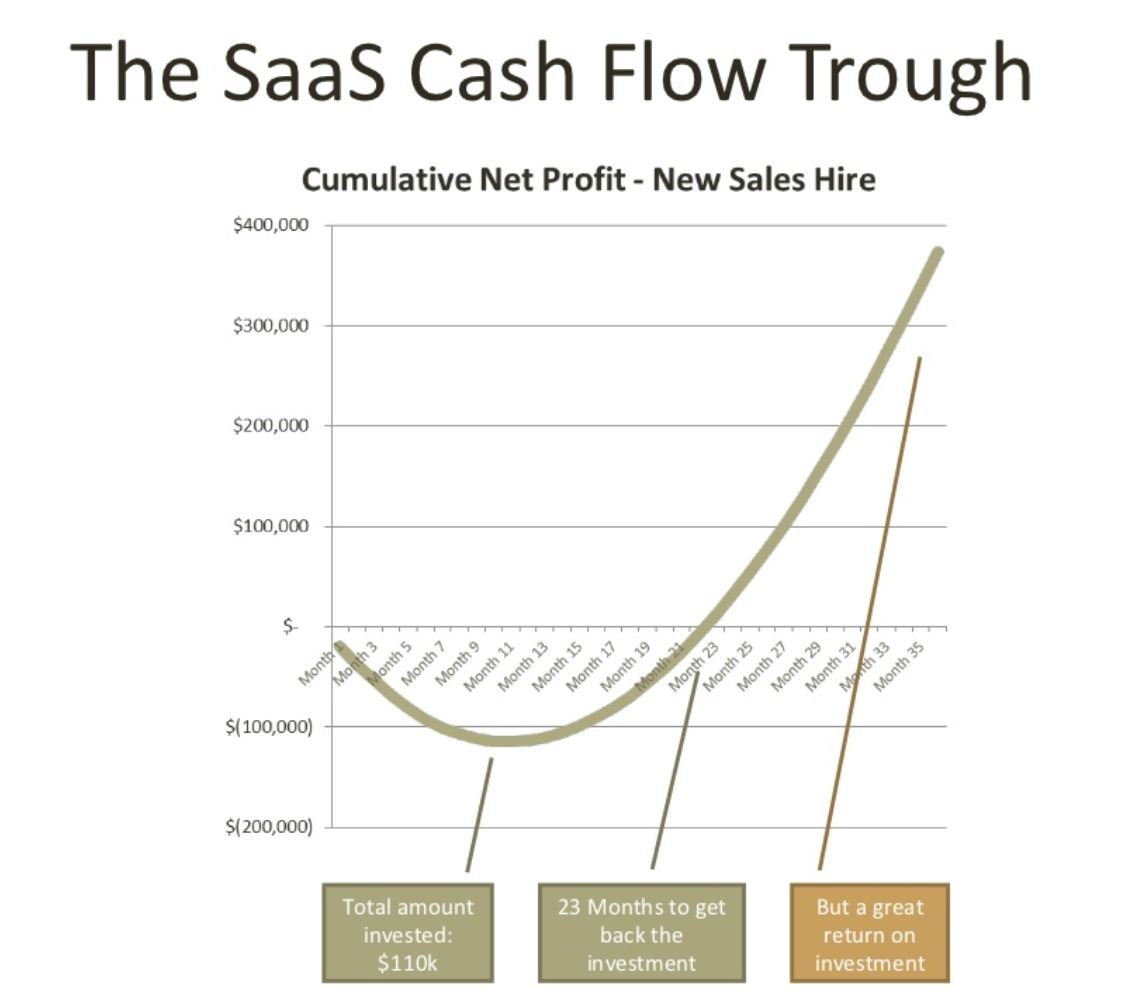

Our typical approach to value SaaS companies is to use the Enterprise Value on Annual Recurring Revenue (EV/ARR) multiple. Because of the way the SaaS model works, companies will typically spend a significant amount of money upfront to acquire customers (when the economics of doing so make sense) and reap the rewards (profits) later over the lifetime of these customers.

This model creates a ‘’cash flow trough’’ and explains why many high-growth SaaS companies don’t generate profits in the early years.

Source: Matrix Partners, www.slideshare.net/DavidSkok/the-saa-s-business-model

Now, if we assume that EV/ARR is the right way to value SaaS companies, what constitutes cheap or expensive?

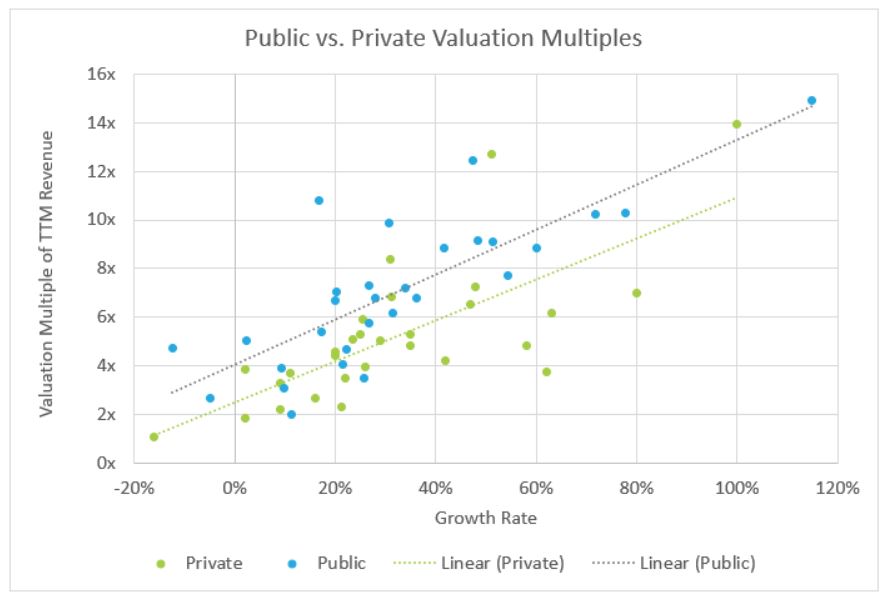

SaaS Capital is a lender to SaaS companies and provides excellent research and data on its website. In a research piece from June 2019, they shared the following chart:

Source: SaaS Capital, Private SaaS Company Valuations: 2019,

www.saas-capital.com/blog-posts/private-saas-company-valuations-2019

There are two interesting takeaways from this data. The first one is that public company valuations are higher on average than private companies by about 2x TTM revenues, which is great because we are looking at a public company here. The second is that the revenue growth rate correlates quite well with the valuation multiple. Fast growth equals higher multiple.

As you will notice in the chart above, SaaS Capital uses a multiple of total revenue, including ARR, setup fees, and any other non-recurring revenue. Since over 85% of Mediavalet revenues are recurring (ARR), we prefer to look at the ARR growth rate and value the company based on its ARR alone.

The company recently pre-announced that ARR for 2019 should be 82% to 85% higher than the previous year. They exited 2018 with $3.5M in ARR, so if we take the midpoint of the guidance and assume 83.5% growth, we get an ARR of $6.42M at the end of 2019.

If we look at the chart above, an 80% growth rate for a public company should approximately result in an 11x to 11.5x revenue multiple.

At an 11x EV/ARR multiple as per the chart above, on a fully diluted basis, this gets us to a value of $2.16 per share, or a 52% upside from current price. Today, the company is valued at a 6.7x EV/ARR multiple.

If we look one year forward and add another 80% of growth to ARR, this gets the company to $11.6M in ARR. At the same 11x revenue multiple, which would still be justified, the resulting share price would be $3.70, or 161% upside from here. You can do the math and look a few more years out. If the growth rate remains the same, or even if it were to slow down a little, the stock quickly starts to look very cheap.

The last thing we want to highlight regarding the valuation is the recent acquisition of another high-growth SaaS company, VersaPay (VPY.V), by a private equity firm.

You can read the full news release here, but here are the main takeaways:

- VersaPay was acquired by a Boston-based private equity firm in an all-cash offer

- It had reported 90% revenue growth in its most recent quarter

- It had Annual Recurring Revenues (ARR) of ~$9.4M

- The transaction valued VersaPay at 13.4x ARR

In comparison, Mediavalet is also a high-growth SaaS company which should report 82% to 85% ARR growth for 2019 (based on company guidance), for a total ARR of ~$6.42M. When we look at the two companies, we see quite a bit of similarity on the financial side. We certainly wouldn’t be surprised if a private equity firm eventually tried to acquire Mediavalet. Just as an example, a 13.4x ARR multiple like VersaPay would put Mediavalet at $2.60 per share today.

It also seems that the VersaPay transaction was a wake-up call for Canadian investors, who realized how much some of the Canadian publicly-traded SaaS companies are undervalued. We believe this partly contributed to the move in Mediavalet stock price since December.

As long as ARR growth remains strong, we think that an increasing awareness from investors will result in the stock trading closer to the EV/ARR multiple it deserves over time.

Potential Catalysts

- Announcements of sizeable recurring revenue contracts

- Release of FY 2019 and Q1 2020 results with sustained growth in net billings

- Realization by the market that the company will not need to do another financing to sustain a cash burn

- Possible acquisition by private equity

Risks

- The main risk is that the company needs to sustain the current level of net billings to at least be cash flow breakeven (or very close). A slowing down of net billings would increase the cash burn and might force the company to raise more capital eventually, although this is now less likely if all $0.90 warrants get exercised before their expiry in April.

- Competition could intensify in the industry, which might make it more difficult for Mediavalet to win new clients.

- If the CEO or CFO/Chairman were to leave the company, we would view this as unfavorable.

- The significant amount of warrants could create an overhang on the stock and prevent it from moving higher. With the accelerated expiry of a majority of warrants, we believe this is only a temporary potential issue.

- Some might argue that the valuation is not cheap, which could prove to be true if the growth rate slows down and the revenue multiple contracts instead of expanding.

Disclosure

Espace MicroCaps is under contract with Rivemont Investments (“Rivemont”) to provide securities and strategy analysis for the Rivemont MicroCap Fund (the “Fund”). In other words, Espace MicroCaps acts as an external expert/consultant for the Fund. In return for this expertise, Espace MicroCaps is remunerated by Rivemont. Decisions as to whether or not to trade a security for the Fund are made exclusively by Rivemont.

As of February 27th, 2020, the Rivemont MicroCap Fund holds a position in Mediavalet (MVP.V). This position is subject to change without any notice, at the sole discretion of the Rivemont MicroCap Fund portfolio managers.

This article is neither an offer to sell nor a solicitation of an offer to purchase securities and should not be considered legal, tax, financial or investment advice. Several estimates and assumptions have been used in the writing of this article. Espace MicroCaps does not guarantee the validity of the information presented.

Espace MicroCaps is not responsible for direct or indirect trading losses caused by the information presented on this blog. Everyone is advised to make their own analyses and inquiries and to consult their own professional advisers with respect to legal, tax, accounting and other matters relating to the acquisition, holding, or disposition of an investment.